What is a VCT?

A VCT (Venture capital trust) is a tax efficient UK closed-end collective investment scheme that invests in small companies. VCTs are either unquoted or trading on the AIM (formerly the Alternative Investment Market) with the intention of returning a profit to investors.

Venture capital trusts, which are generally themselves listed entities on the London Stock Exchange, were introduced by the government in April 1995 and were designed to encourage investors to invest directly in a range of small higher-risk companies whose shares are not listed on a recognised stock exchange.

They can generally be separated into two different types: Limited Life and evergreen.

All you need to know about Venture Capital Trusts

VCT tax relief

Venture capital trusts are run by fund managers who are usually members of larger investment groups. These professionals spread the risk of investing in early-stage companies by investing in a portfolio on your behalf.

Income Tax relief

Exemption from Income Tax on dividends paid on ordinary shares in VCTs.

Income tax relief of 30% on the value of new ordinary shares subscribed. This relief is available on investments up to £200,000 in a tax year.

All shares must be held for at least five years or the Income tax relief received must be paid back. The shares must be new ordinary shares and must not carry any preferential rights or rights of redemption at any point in time within five years of the shares being issued.

Capital Gains Tax relief

You may not have to pay Capital Gains Tax on any gain you make when you dispose of your Venture Capital Trust shares (this is called disposal relief).

You can get two of the reliefs, dividend relief and Capital Gains Tax exemption for example, through the Stock Exchange. But Income Tax relief can be claimed only if you subscribe for new shares.

You can get Income Tax relief for a tax year if shares in Venture Capital Trusts for which you subscribed up to a maximum of £200,000 are issued to you in the year. A tax year begins on 6 April in one year and ends on the following 5 April. You can claim the reliefs, where applicable, from the Tax Office which deals with your tax affairs.

What are the drawbacks of a VCT?

VCT costs

Like all managed vehicles these trusts incur fees. Venture capital trust annual management fees tend to range between 2% to 3% per year. In addition to that, the initial charges for investing in a VCTs are generally around 5% and, Venture Capital Trusts tend to charge around 2% for each investment that they make. You may have got 30% back in tax relief but nearly that same amount is eaten up in fees by the management team.

VCT holding period

To keep your tax relief on a venture capital trust investment an investor must hold the shares for a minimum of 5 years. If the investment is a tax play then there are other vehicles, EIS and SEIS investments and EIS funds and SEIS funds with shorter, three-year holding periods.

Further, given that Venture Capital Trusts are listed on regulated stock exchanges, there will always be a temptation to get out should things be going well or if capital is required. Tax relief is also subject to change and is dependent on each individuals' set of circumstances. They are also dependent maintaining its VCT-qualifying status.

Venture Capital Trust alternatives

We've brought together two alternatives to Venture Capital Trusts to give you a flavour of the differences.

VCT vs EIS

An Enterprise Investment Scheme fund or EIS fund for short, is a managed investment vehicle that raises cash from individuals and institutions for the purpose of investing in a portfolio of EIS eligible ventures. EIS funds offer generous tax breaks including relief of 30% the amount invested off your tax bill. SyndicateRoom's Access EIS is one such example. The fund co-invests with some of the UK's best-performing startup investors and offers a diversified portfolio of 50+ investments in order to manage the risk of investing in early-stage equities.

For a more detailed comparison, read our free guide comparing EIS vs VCT tax reliefs.

SEIS funds

A Seed Enterprise Investment Scheme fund, or SEIS fund for short, is a managed investment vehicle that raises cash from individuals and institutions for the purpose of investing in a portfolio of SEIS-eligible ventures. SEIS funds offer generous tax breaks including relief of 50% of the amount invested off your tax bill.

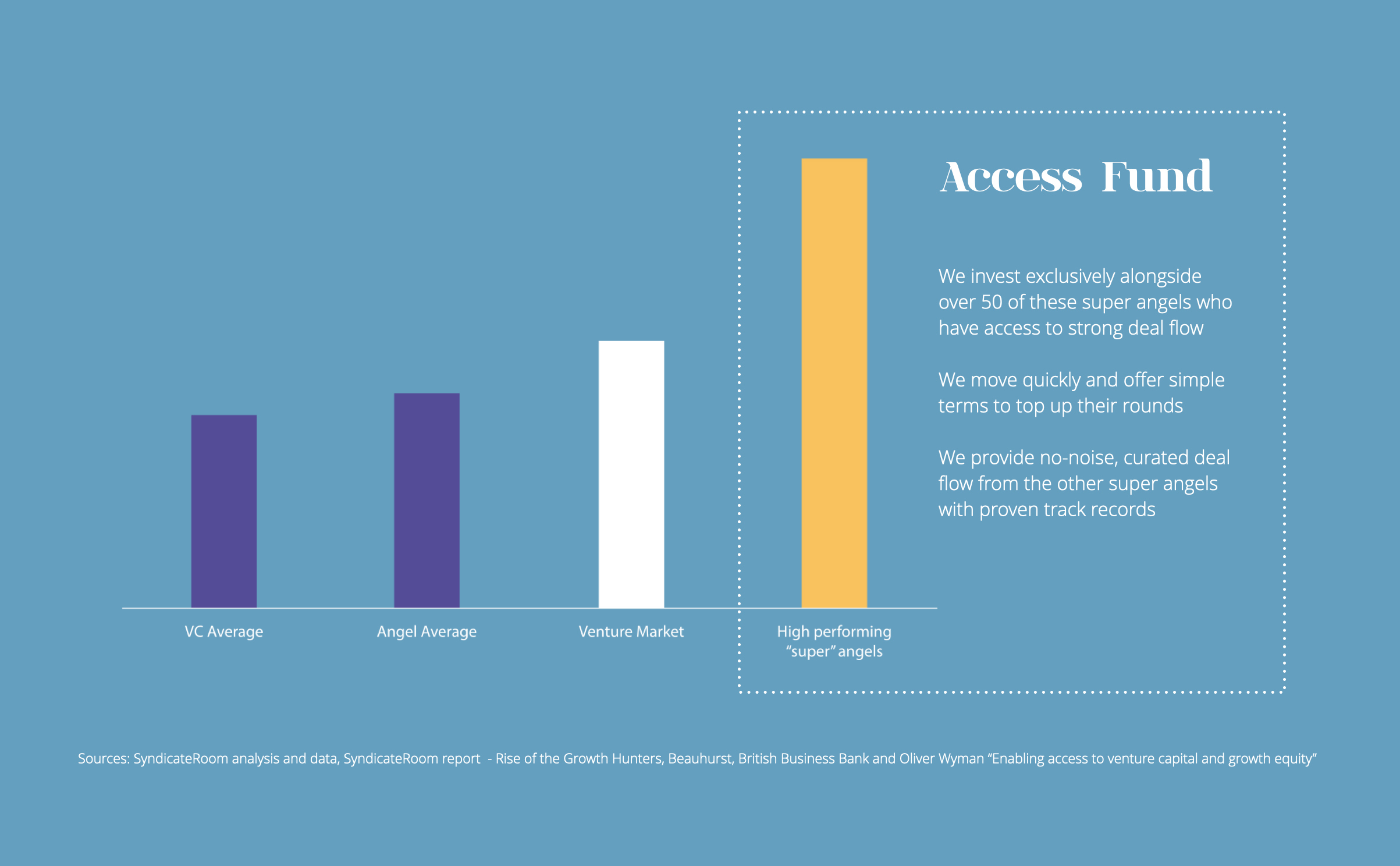

Tax benefits through Access EIS

SyndicateRoom's fund, Access EIS, tracks the performance data of over 1,000 active startup investors. It then selects and co-invests with some of the best-performing “super angels” with the aim of replicating their collective success, and diversifying your investment across at least 50 super-angel-backed startups to minimise risk and capture as many potential “blockbusters” as possible. The angels we co-invest with significantly outperform the market.

We make the process of claiming relief on multiple investments as simple as possible for our investors.

Disclaimer

The information on this page does not constitute financial advice and is provided on an information basis only, based on research using the following sources: