In late March and April, SyndicateRoom added eight new startups to the Access EIS portfolio, investing alongside super angels in each case (for more on our super angels, and our co-investment model, see our dedicated page). Find out more about our fund, Access EIS, or read about our new portfolio companies below.

Tom Savano.

Tom Savano is on a mission to bring the world's most beautiful travel-inspired cocktails to anyone, having developed and launched a multi award-winning collection of super premium cocktails that are ready to enjoy with just the pop of a cork as if you were in the world's best bars. It currently has listings in John Lewis, CinqueCento Pizzeria and Fenwicks.

Our angel partner in the round has a weighted IRR of 31% and has invested into Rapha, Double Dutch, and Direct ID, to name a few.

Total Round: approx. £500,000.

Stage: Post-revenue.

Growyze.

Growyze is an all-in-one inventory and stock management app for pubs and bars that saves users time and money in a smarter, greener and more efficient way.

Our angel partner in the round has a weighted IRR of 37% and has invested in Novastone, ScreenCloud, and RotaGeek, to name a few.

Total Round: approx. £450,000.

Stage: Pre-revenue.

Pri's Puddings.

Pri's Puddings make indulgent treats using just five natural ingredients, sweetened by dates, so they contain 50% less sugar than mainstream competitors. They’re plant-based, gluten free and wrapped in 100% recyclable packaging.

Our angel partner in the round has a weighted IRR of 31% and has invested into Rapha, Double Dutch, and Direct ID, among others.

Total Round: approx. £400,000.

Stage: Post-revenue.

Genie.

"Genie is the creative industries' first automated talent agent, underpinned by an intelligent AI powered matching algorithm, which matches companies to the best talent at speed. The SaaS platform enables creative companies to be strategic about building an agile, hybrid, workforce."

Our super angel in the round has achieved a flat average CAGR of 53% on angel investments and his invested in Allica Bank, Flagstone, and proSapient among others.

Total Round: approx. £1,500,000.

Stage: Post-revenue.

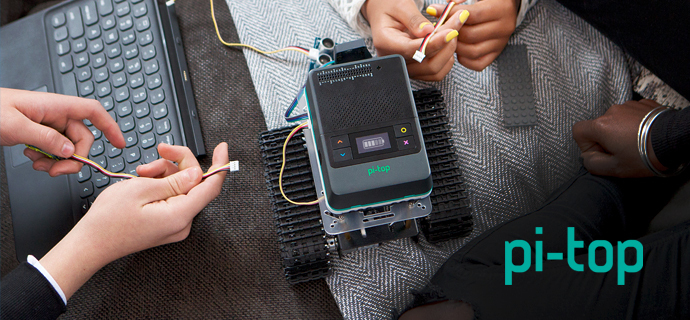

Pi-top.

Pi-top’s award-winning hardware and software ecosystem is used around the world thousands of homes, maker spaces and schools, blending physical computing and project-based learning with Computer Science and STEAM (science, technology, engineering, arts and maths) education. With its latest product, pi-top [4], educators and students get to design, code and make anything they can imagine.

The super angel in the round has achieved a falt avg CAGR of 38% on angel investments having invested in Cambridge Mechatronics, wejo, and Aircraft Medical, among others.

Total Round: approx. £2,000,000.

Stage: Post-revenue.

Bequest

Bequest simplifies the process of getting life insurance, making it easier than ever for everyday people to get covered.

Our angel partner in the round as a weighted IRR of 64% with previous investments including Atom, Monese, and Smart, to name a few.

Total Round: approx. £2,000,000.

Stage: Post-revenue.

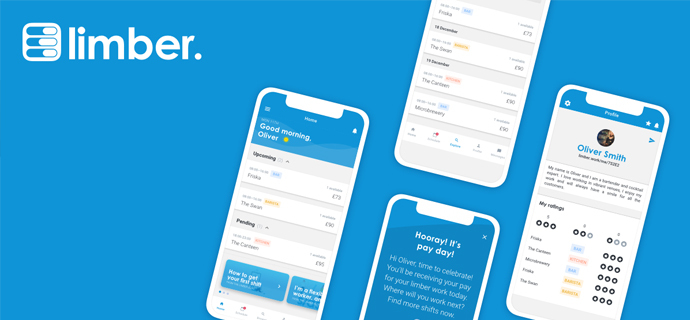

Limber Jobs

Limber is a shiftworking marketplace designed to help employers and staff work flexibly together. Employers post shifts, staff apply and Limber manages payment, payroll and paperwork. An aggregator of shifts and people, the app allows hospitality venues to access previously inaccessible talent and hire from the ever-expanding gig economy, while workers get to say ‘no thanks’ to traditional ways of earning.

Our super angel in the round has achieved a flat average CAGR of 54% on angel investments having invested in Auroch Digital, Space Forge, and GenomeKey to name a few

Total Round: approx. £400,000.

Stage: Post-revenue.

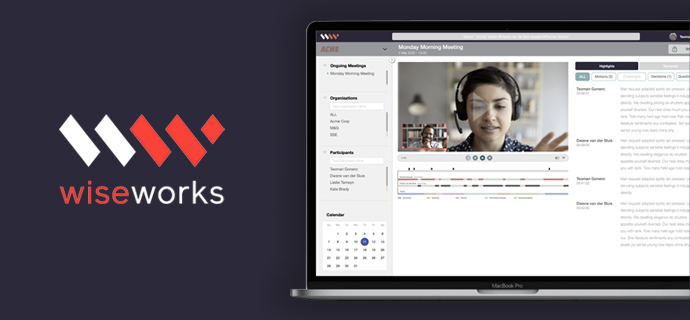

Wiseworks

This company is a communications intelligence platform allowing financial institutions to extract critical insights from audio and video interactions.

Our angel partner in the round has a weighted IRR of 39% and has invested in Healx, Unibound, and Exonate, among others.

Total Round: approx. £750,000.

Stage: Pre-revenue.

Please note: our office hours are weekdays, 9.30am - 5.30pm.