Please note: our office hours are weekdays, 9.30am - 5.30pm.

Tax treatment depends on individual circumstances and may be subject to change.

What do you want to know about SEIS?

What is the Seed Enterprise Investment Scheme (SEIS)?

The Seed Enterprise Investment Scheme offers private investors generous tax reliefs

on investments into early-stage British companies. Introduced in 2021, investors may

claim relief on up to £200,000 invested through the scheme per annum. Relief applies

to investments made directly into companies or through an SEIS fund.

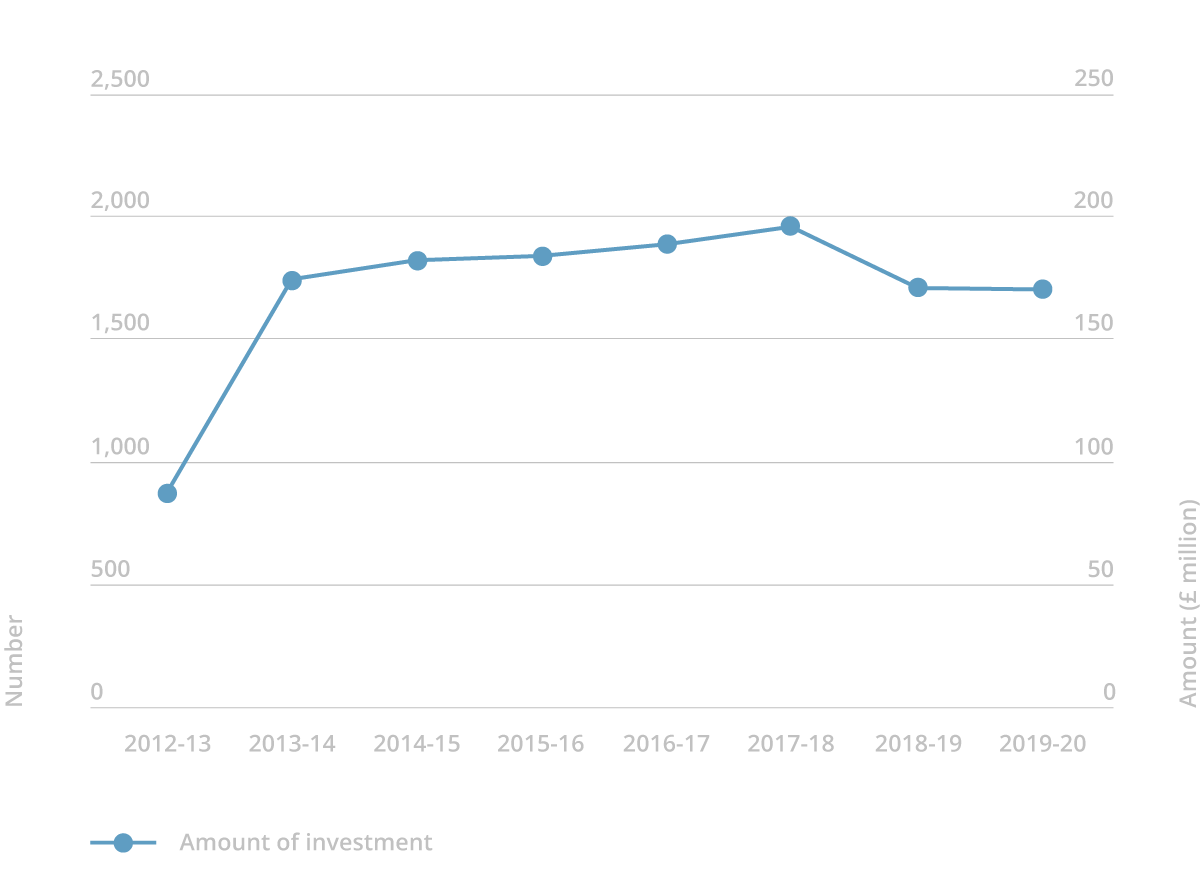

In each tax year since 2013/14 over £150 million was invested through the Seed EIS

scheme.

Risk warning: Tax relief depends on an individual's circumstances and may change in the future. The availability of tax relief depends on the company maintaining its qualifying status.

SEIS tax relief

The Seed Enterprise Investment Scheme offers many tax reliefs to individual

investors. These include income, capital gains, loss, and inheritance tax relief.

The reliefs can be claimed on up to £200,000 invested through the scheme per tax

year.

The minimum holding period for all reliefs except inheritance tax is three years.

Inheritance tax relief applies to shares held for at least two years.

Investors may apply the income tax relief to the tax year of their investment or

carry it back to the previous year.

HMRC will clawback reliefs given on shares disposed before the holding period

expires.

Your free guide to investing in startups

How do I calculate my tax relief?

Start by multiplying the amount invested into a qualifying company by 50%. If

investing via a fund subtract the upfront fund fees from the amount.

This is the amount you can claim as a reduction on your income tax bill. For

example, if you invested £1000 into an eligible company you would be able to claim

£500 in income tax relief.

If that company were to fail, you may claim further loss relief.

How do I calculate loss relief?

To calculate loss relief, multiply your investment, less the income tax relief

received, by your income tax bracket i.e. 40% or 45%.

For the example above, the amount you can claim in loss relief is £500 multiplied by

your income tax bracket. Assuming this is 45%, you’ll be able to claim a further

£225 in loss relief. This can be applied as income tax relief or set against capital

gains.

How do I reduce capital gains tax?

SEIS reinvestment relief offers investors a reduction of capital gains tax.

Investors may reduce a capital gains tax bill by half of the amount invested into

the scheme. Here’s a visualisation of the SEIS relief received. The examples assume

you invest £1000 into an eligible company.

You will see three scenarios depicting possible investment outcomes. In the first

scenario the company goes bust. Be warned, this is the most likely scenario. Most

startups fail. In the second the company breaks even and in the third the company

doubles in value.

For these examples, we will assume an income tax rate of 45%. Where applicable, we

will suppose that you owe capital gains at 28%.

How do I claim my tax relief?

First, you must have received an SEIS3 form from the company in which you have

invested. This form confirms the amount invested and confirms it is eligible for tax

relief.

The SCEC (part of HMRC) issues a company with SEIS3s. This occurs when it has been

trading for four months or if it has spent 70% of its total investment. The company

then passes an SEIS3 form on to each investor, who completes and submits it as part

of their tax return.

Note, HMRC may ask to see your SEIS3 form even after processing your taxes. Be sure

to keep it safe.

Tax relief can be claimed up to five years after the 31st of January of the year you

make the SEIS investment.

How do I invest in SEIS?

SEIS investments come in two forms, direct investment or through an SEIS fund.

Direct investments

Invest through angel networks, accelerators or online via equity crowdfunding

platforms.

Platforms offer many investments but may lack due diligence. Read more about angel

investors.

SEIS funds

SEIS relief applies only to individuals and not, for example, companies or trusts.

To qualify for Income Tax relief, you cannot be ‘connected’ to the investee company.

You are "connected" to the company if you are a paid company employee, partner or

director. The exception is if you are an unpaid director of the company, in which

case you may still claim Income Tax relief.

You are connected to the company if you have a 30% or greater interest in the

company or any subsidiary. This includes share capital, voting rights and the rights

to assets).

No partner or associate of the investor may have other interests in the company.

What kind of shares are eligible for SEIS relief?

Shares must be new, ordinary shares. They must be non-redeemable and have no special

rights attached. Investors must pay in full and in cash (not any other assets) to be

eligible for Income Tax relief. You cannot use a loan to buy the shares if it was

only approved for the purchase of the shares.

The 'risk to capital' condition applies to shares issued on or after 15 March 2018.

What type of company qualifies for SEIS?

The companies who qualify for SEIS are at a very early stage. They must be trading

for under 2 years, have fewer than 20 employees and less than £200,000 in gross

assets. The company can raise up to £150,000 under the scheme and the tax relief may

only apply on ordinary shares issued.

Companies can apply for SEIS Advance Assurance. Before investing in a company ask if

they have done so.

What are the alternatives to SEIS?

EIS and SEIS are similar in reliefs offered with a few differences. With EIS the income tax relief is 30%, not 50%. Further, investors may defer an existing capital gain by investing it into EIS or an EIS fund.

A VCT is a listed vehicle that, like EIS, offers investors income tax relief 30%. Unlike EIS, VCTs offer investors tax free dividends but not capital gains deferral. VCTs have a five-year holding period to maintain the relief.

The information on this page does not constitute financial advice. It is provided on an information basis only using research from the following sources: