There are few things certain in life: death, taxes, and the Access EIS Fund being one of the most active early-stage funds in the country. As 2023 winds down we've taken a look back on the portfolio Access has invested in over the last 12 months and we're delighted to share a look into what the fund has done.

The numbers

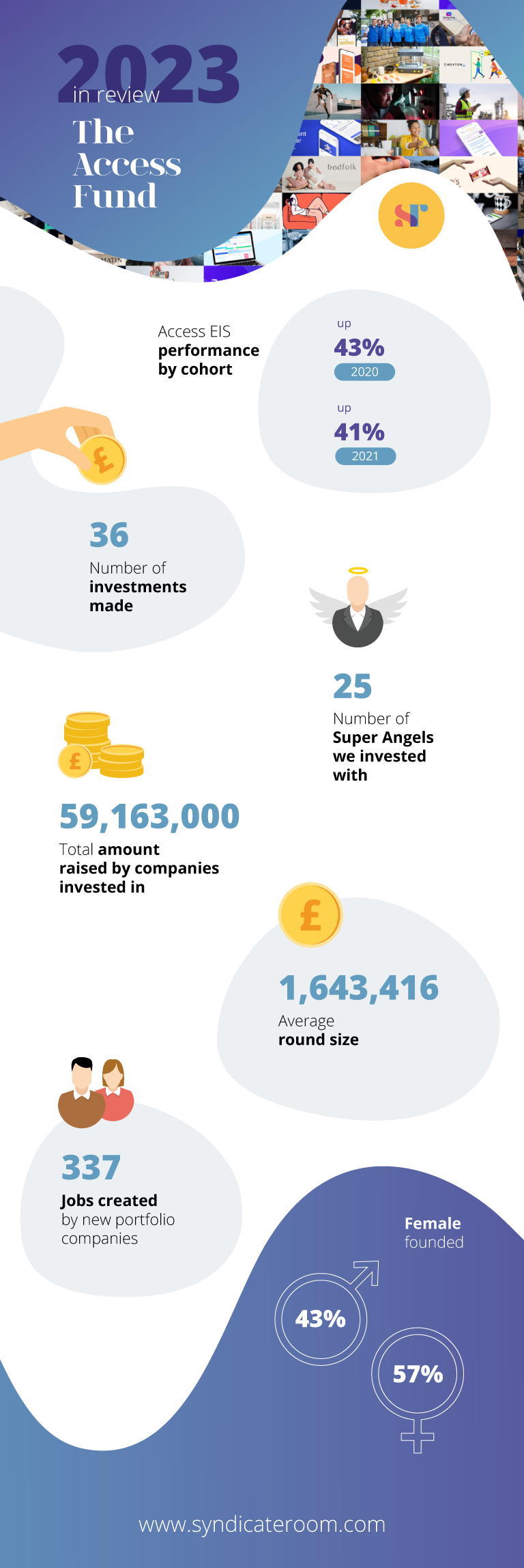

Starting with the big picture, we've completed investment on nearly 40 companies who raised over £60,000,000 combined, with an average funding round size of over £1.5 million. This is the highest average funding round we've seen since launching the fund in 2020.

Every company we invested in this year has a primary or secondary impact focus, most of them environmental or social.

43% of the companies we invested in are female-founded, approximately 2.5x the UK average.

The portfolio

As with every year we've invested in an incredibly diverse portfolio of startups working to solve problems across a range of industries and sectors. For more information about the performance of the fund, you can see our latest Biannual Report.

Pencil Biosciences is developing a platform to edit the DNA of any cell that will enable the development of cures currently untreatable diseases including inherited genetic diseases and certain cancers.

Freja Foods, whose broth-based products are now stocked at several major supermarket chains and on Ocado, have saved over 50 tonnes of food waste.

37 Clinical's technology can predict the deterioration of chronically ill patients and help them avoid hospitalisation. Our funding round helped them advance clinical studies which should help them secure a commercial partner for their product next year.

Five Alarm Bio is improving the treatment of chronic disease by developing novel approaches to anti-aging, with broad potential therapeutic applications.

Inhabit is managing and actively reducing 40,000 tonnes of carbon from the atmosphere. It has over 50 businesses developing SBTI-aligned decarbonisation strategies and is developing tools for the built environment to reduce the impact of buildings in the design phase, reducing the social and environmental impact of construction projects before they begin.

Luna is improving the mental health of girls and non-binary teens on their health and help to improve their mental health.

Neat is reducing plastic waste and carbon footprint vs traditional cleaning and personal care products.

The funding rounds we've participated in have led to our portfolio companies achieving a huge trove of milestones, from product development to launches, conversions, doubling team sizes and implementing AI.

The year ahead

2023 has been a difficult year for companies and investors alike, and while 2024 is expected to be more of the same, inflation and interest rates are expected to fall. Despite these conditions, companies are managing to weather the slowdown and do impressive work. Two of our fund cohorts have seen very encouraging growth – the 2020 and 2021 cohorts saw increases of 43% and 41% respectively. As startup valuations continue to fall throughout 2024, we expect to see more investors taking advantage of the chance to build their private holding.

The performance of these two cohorts through a series of unprecedented challenges since 2020 shows that building a large, diversified portfolio of high-quality companies, hand-picked by the UK's leading angel investors, can deliver strong growth potential and drive access to what might become the UK's next unicorns.

The fall in company valuations together with the potential for growth are attractive. They become more so once the tax reliefs available to EIS investors are considered, particularly in a year which is likely to see a higher number paying more tax due to tax band freezes and fiscal drag. Throw the falling capital gains tax free allowance into the mix – it falls again next tax year, from £6,000 to £3,000 – and the option to defer gains through EIS starts to look increasingly attractive too.

So with optimism for the year ahead, we hope you have a wonderful New Year and that 2024 is prosperous.

From all of us at SyndicateRoom.

Get your free guide to EIS and capital gains tax

Manage your capital gains with EIS.

The Enterprise Investment Scheme offers investors significant tax reliefs which range from income tax relief to capital gains tax (CGT) deferral and disposal relief. If you want to get up to speed on EIS CGT deferral rules, the CGT deferral relief time limit and more, download our free guide to how the capital gains tax reliefs work, how to claim them and how to get started as an EIS investor.

Please note: our office hours are weekdays, 9.30am - 5.30pm.