Entrepreneurs often ask us how to find angel investors for their startups. One obvious option is to check out angel groups and follow their steps for making a pitch. But in general, most founders find angel investors by networking which can itself become a full time job as you try to track down investors with the right experience and interests. There is another way to find angel investors that are more likely to be a match for your startup, and should save you some time.

Step 1

Identify startups in your industry that raised capital or, even better, had an exit. This should be an exercise you have already completed when building your pitch deck. Go through startups that are not doing exactly what you do, but exist in the broader industry sphere. This can include applying the same technology (e.g. machine learning) in a separate area (e.g. heath AI vs cyber security). The list should be around ten startups, and all of them should have raised capital in the past couple of years. Ideally, one or two will have had an exit. Make sure you get the trading name of the company (typically the name which ends in “ltd” or “limited”). We’re about to go and find who has invested in these companies. As an example, let’s say you have a subscription vegan snack box delivery company. You could look at Butternut Box which does subscription dog food delivery. No, I’m not saying vegan food is the same thing! You don’t want the company to be too similar to your own, as investors might not want to invest in exactly the same type of company twice, but they will see enough similarities to know they could do well again. Butternut Box trades as Dogmates Ltd.

Step 2

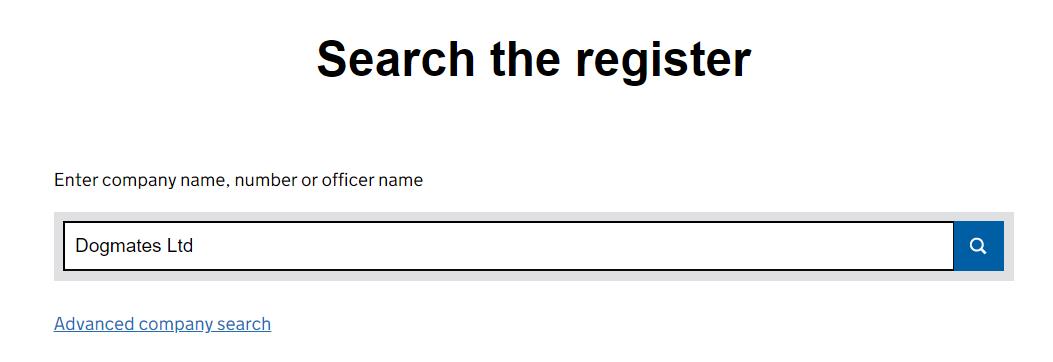

Go to Companies House and find those companies.

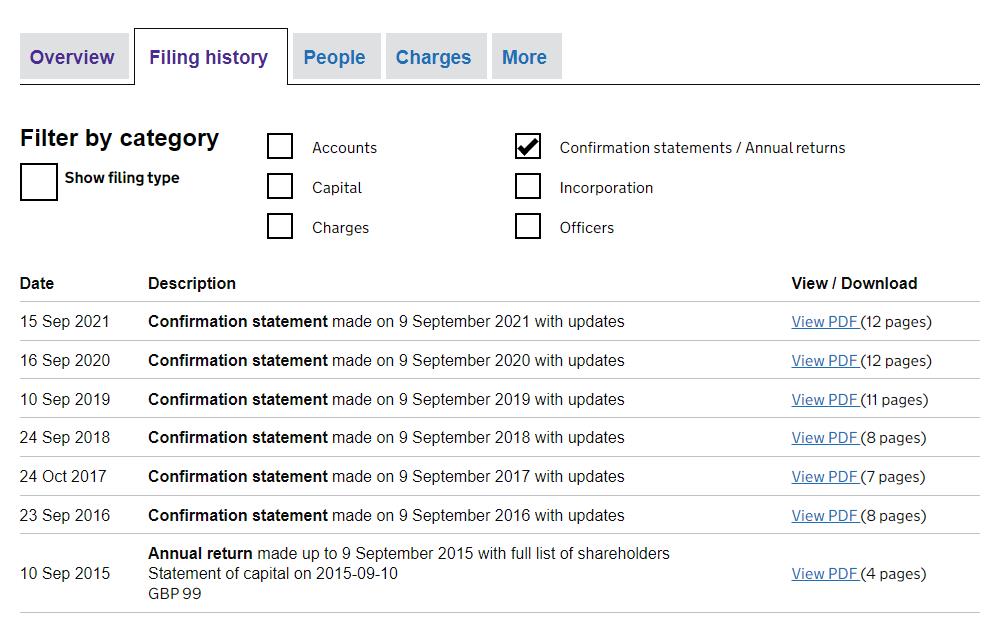

Simply search for the company by name on Companies House and go to their filing history. Filter for Confirmation Statements (these will show you who is on their cap table).

Step 3

Identify the angel investors. Go through the PDFs to find names with a high shareholding. The first names on the PDF will be the founders (you can confirm their names on the company website or on Crunchbase). If the list is quite long, go to one of the older filings to see who their first investors were. In the case of Dogmates, we can see in their 2017 filings that Passion Capital showed up alongside a number of new names. This clearly suggests a funding round, which we can confirm on Crunchbase (you can also confirm it by looking at other filings but it’s simpler to go to Crunchbase for this type of analysis). I can see that Christian Huot appears to be one of the largest shareholders who joined in that round, so I search for him on LinkedIn. Indeed, a search on him reveals that he’s a director at “Continuity Capital, which is an independent UK investment firm focused on producing exceptional long-term results by investing in small high quality growth companies”. He could be a good person to pitch to.

Step 4

Search and network. There’s nothing clever about the final step. Now you’ve got some names, you will have to search for them and use your network to connect. Remember, a warm intro is much more likely to succeed than a cold one, so see how you are connected. Many people might not respond and those that do might not be interested – welcome to fundraising. Some of them may not be angel investors but just friends who joined the round. Finally, don’t just email them asking for investment. You know the company they’ve invested in before – ask them about their experience and if they could give you advice. Even if they don’t invest, you can still learn a lot for building your business. Some of these conversations could also develop into firm connections or introductions which will help to build your network, and could make finding an investor easier further down the line. Find out more about our fund, [Access EIS](/invest).

Please note: our office hours are weekdays, 9.30am - 5.30pm.