If you believe the majority of startup founders who receive funding are male, well, you're right. Only 2.5% of the total capital invested in venture-backed startups in the US in 2019 went to female-led companies.

But, if you believe this is because men do better, have a better chance of success, or are just somehow more suited to running businesses: you’d be very wrong.

Here are three reasons why female-led startups are the future:

1. Female founders do better.

A 2018 study, “Why Women-Owned Startups Are a Better Bet”, by Boston Consulting Group found that for every dollar of investment raised, startups with at least one female founder produced 78 cents in revenue, compared to 31 cents generated by all-male run startups. Startups founded or co-founded by women also performed better over time, generating 10% more in cumulative revenue over a five-year period: $730,000 compared with $662,000.

2. The market is beginning to wake up to the power of women in business.

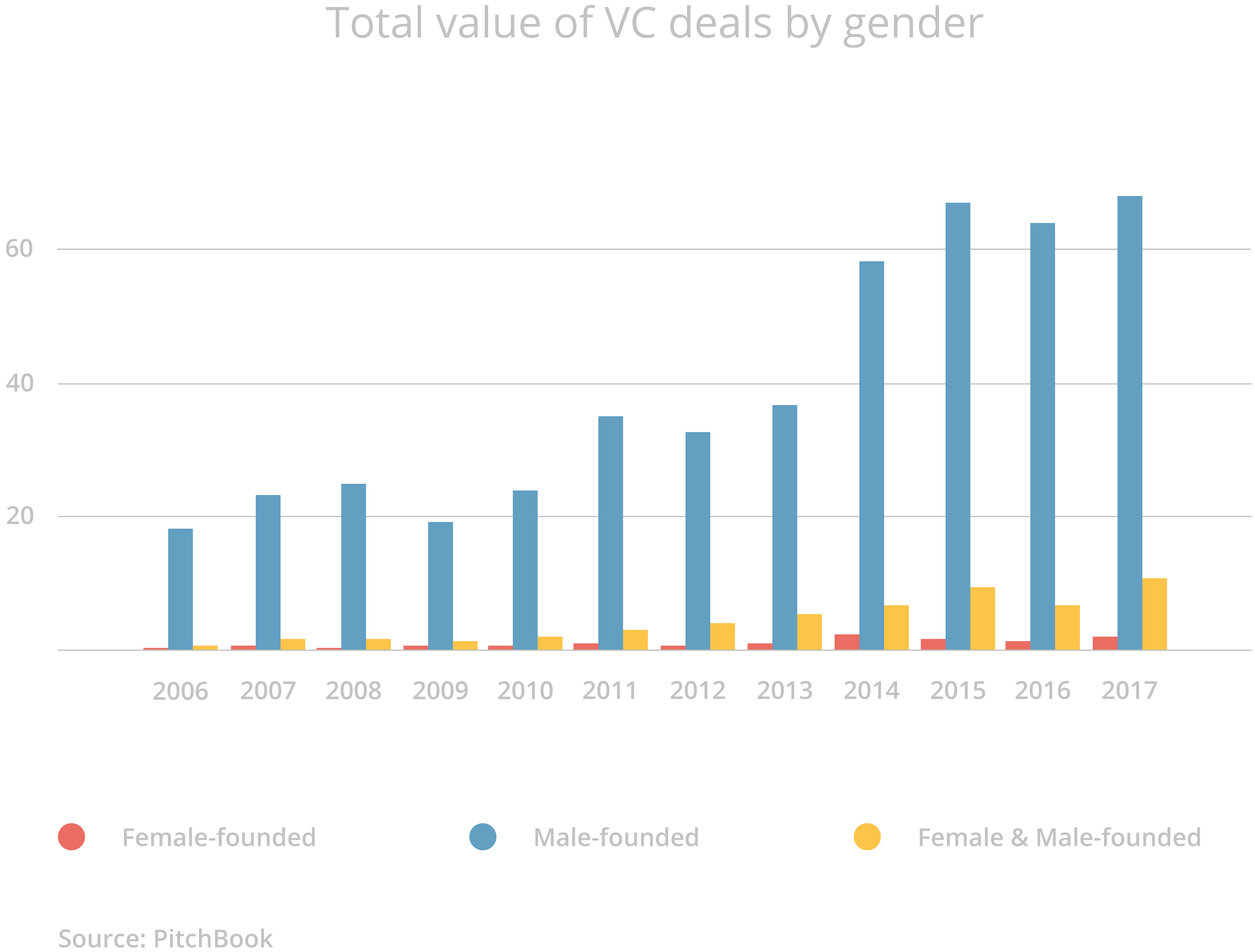

During the past decade, the percentage of deals with women on founding teams has nearly doubled, from 7.9% to 15.7%, according to PitchBook's December 6, 2019 update. More and more research findings, including a 2019 study by HEC Paris, illustrate how gender diversity delivers higher returns and a lower risk of failure, making it sensible for investors to think carefully before backing all-male founded companies.

Get your free guide to EIS

Want more information on EIS tax reliefs?

Download your copy of our free guide. Featuring an analysis of UK investor trends, investment case studies and an EIS cheat sheet.

3. More and more VC partners and angel investors are female.

Part of the reason male-founded companies are able to win such a large proportion of venture capital investments is that the vast majority of VC decision makers are male, and there’s a lower chance that male VC partners will choose female-founded businesses. A 2020 report by Kauffman Fellows found that female VC partners invest in twice as many startups with at least one female founder.

It’s quite a frustrating statistic. But, since 2016, the number of female-led venture capital firms in the US has quadrupled. In the UK, the number of female angels grew from 9% in 2017 to 13% in 2019, according to the UKBAA’s 2020 UK Business Angel Market report. Slowly but surely, the number of female decision makers in VC, the number of female business angels, and the awareness of the importance of gender diverse teams to success is slowly improving, although it still has a long way to go.

A diverse fund.

The Access EIS fund is proud that more than one third of the companies it backs have at least one female founder. We are strong believers in both the ethical, and the business case for diversity, and if you are too, you might want to consider an investment with us.

Please note: our office hours are weekdays, 9.30am - 5.30pm.