What is a high-return investment?

It is the goal of every investor to maximise the returns they achieve while minimising risk. High return investments play a role in this strategy as they aim to generate significant returns. The trade-off, they often come with more risk attached.

In this article, we cover some of the high-return investments and their associated risks. Your job is to learn and make informed decisions about your portfolio.

The common investments targeting high returns

Venture Capital

Venture Capital (VC) is a form of private equity that invests in early-stage startups with high growth potential. In the UK retail investors can invest in three different types of tax-efficient VC funds.

1. EIS funds

An EIS fund (enterprise investment scheme fund) offers investors tax relief for investing in startups. The funds build investors' positions in portfolios of startups ranging from a couple up to 50+. EIS funds generally invest at a later stage than SEIS funds.

2. SEIS funds

Like EIS funds, SEIS funds invest in early-stage companies and offer investors generous tax reliefs for taking on the risk. SEIS funds must invest in companies that have been trading for 2 years or less and have 20 employees or fewer.

For this reason, the seed enterprise investment scheme (SEIS) offers investors more income tax relief than EIS.

3. Venture Capital Trusts

A VCT (Venture capital trust) is a tax-efficient closed-ended collective investment scheme that invests in small companies. VCTs are either unquoted or trading on the AIM market. VCTs offer investors a similar set of tax relief to EIS funds. They do not offer the same special form of loss relief if the investment loses value.

Cryptocurrencies

A cryptocurrency is a digital currency designed to work as a medium of value exchange. In a similar fashion to foreign currency, investors buy, sell, long and short cryptocurrencies. If they time the market just right they will profit. Cryptocurrencies are susceptible to wild swings in valuation. These swings can lead investors to gain or lose large amounts quickly.

High yield bonds

High Yield Bonds are corporate bonds rated below BBB− or Baa3 by established credit rating agencies. This is why they are often referred to as junk bonds.

Historically, high-yield bonds achieved similar returns to equity markets with lower volatility. However, their BBB rating suggests a higher potential risk investors must accept before investing.

How to choose the right high return investment for you

Consider your risk tolerance

SEIS funds, EIS funds and VCTs all invest in early-stage companies where the failure rate is high. Cryptocurrencies are volatile assets prone to large swings both up and down. High Yield Bonds come with a trade-off of a higher potential of default. The common theme is that investors can and will lose money.

Define your investment goals

Before beginning to build an investment portfolio an investor should set their goals for the portfolio. From there work backwards to understand the level of return needed to hit those goals. Speaking to a money coach or financial advisor at this stage can be useful to sense-check the goals and give ideas on the plan. Once the goals are set, an investor can begin building the portfolio required to achieve those goals.

Set a time horizon for your investment

Investing in startups is a long-term investment activity that can take 7+ years for investors to start receiving money back.

High-yield bonds offer a range of durations that may be a few months up to several years.

Cryptocurrencies are tradeable on crypto exchanges. Given the volatility, investors must focus and buy and sell quickly or decide early on to hold for the long term. Determining your strategy before investing is paramount to avoiding emotion-driven transactions.

Diversify your portfolio

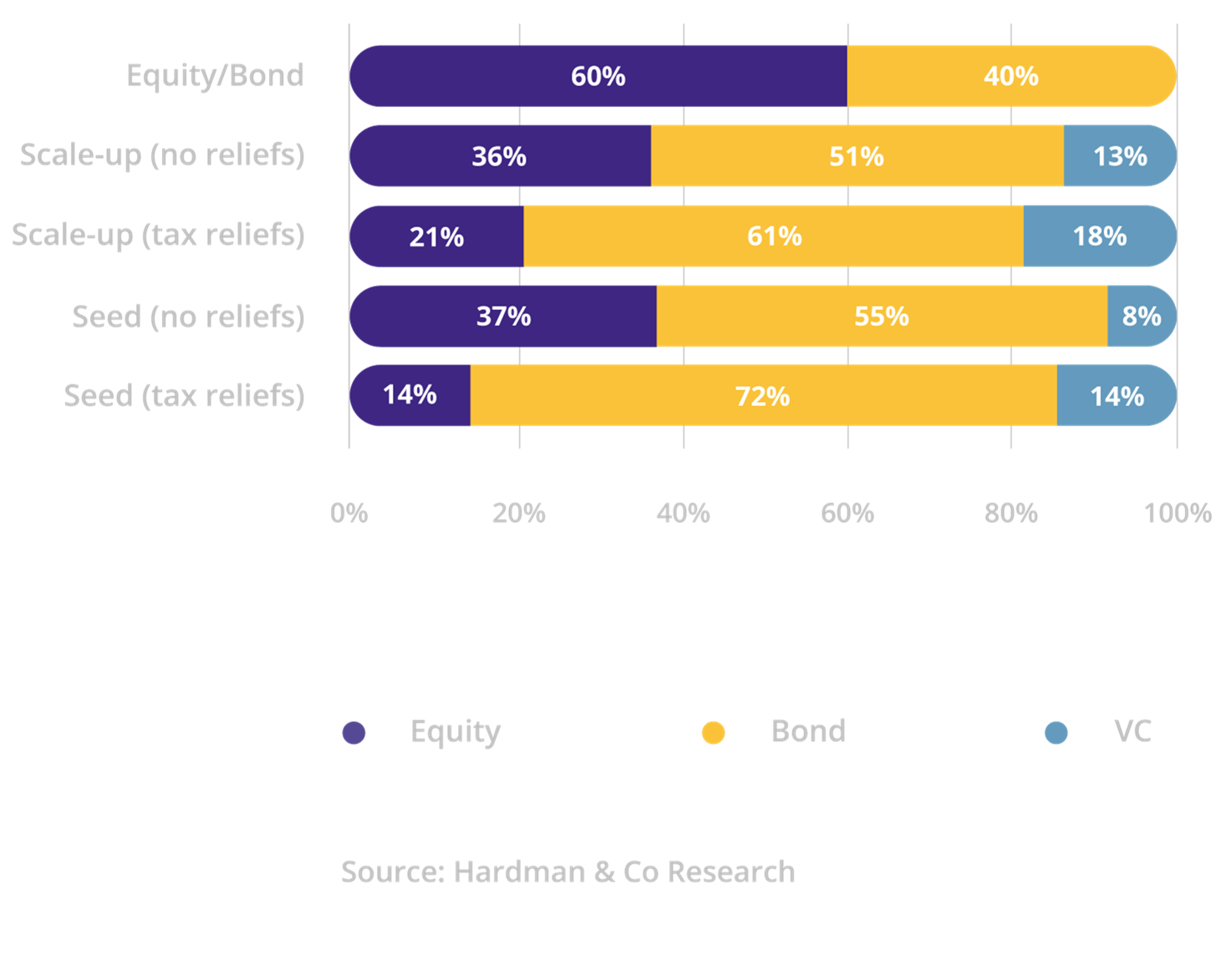

Diversification has proven a useful strategy to minimise loss and increase performance. Note, even with a diversified strategy investors can and do lose capital. High-risk investments can form a part of a well-balanced portfolio. Research by Hardman & Co has shown how having a portion of your portfolio in tax-efficient VC products can lead to better outcomes. Before investing ensure you are comfortable with this level of risk and never invest more than you can afford to lose.

How to balance the risks of high-return investments

Rebalancing a portfolio to include tax-efficient venture capital can lead to better performance. Introducing VC products requires a significant upweighting of safer debt instruments. The chart outlines the rebalancing required to include venture capital in your portfolio. The starting point is a typical 60-40 portfolio. Note that the optimal level of VC depends on the stage at which the fund invests.

The rebalancing of the portfolio depends on the stage of startups one chooses to invest in and the ability to claim associated tax reliefs. Starting with a traditional 60% equity 40% Bond portfolio, the chart below outlines the rebalancing required to include the optimal level of venture capital at the different investment stages.

The impact of including the Access EIS fund in your portfolio

Access EIS offers investors EIS tax relief while building a highly diversified portfolio of startups.

Our research found that the UK venture market has a low correlation, 7% to be exact, with public markets. Thus, including uncorrelated investments can reduce portfolio volatility by increasing asset diversification.

Further, research by Hardman & Co found that including an optimal proportion of venture capital can have a positive impact on portfolio returns while maintaining, or reducing, the overall portfolio risk.

Please note: our office hours are weekdays, 9.30am - 5.30pm.