How much of your portfolio should be in venture capital?

To many investors, there are two key obstacles to investing in venture capital. The first of these is the risk, and the second is a sense that minimum investments are too high to be accessible.

In this article we’ll look at how you can get the balance right between venture capital and other types of investment so that you can incorporate VC into a balanced portfolio and benefit from an increased return potential while keeping the risk profile manageable. We’ll also show that there are funds that make investment much more accessible than others.

First we will take a look at the asset class, its risks compared with other assets, and how including it in a broader portfolio could increase returns of an adjusted portfolio while decreasing overall portfolio risk.

The undeniable risk of venture capital

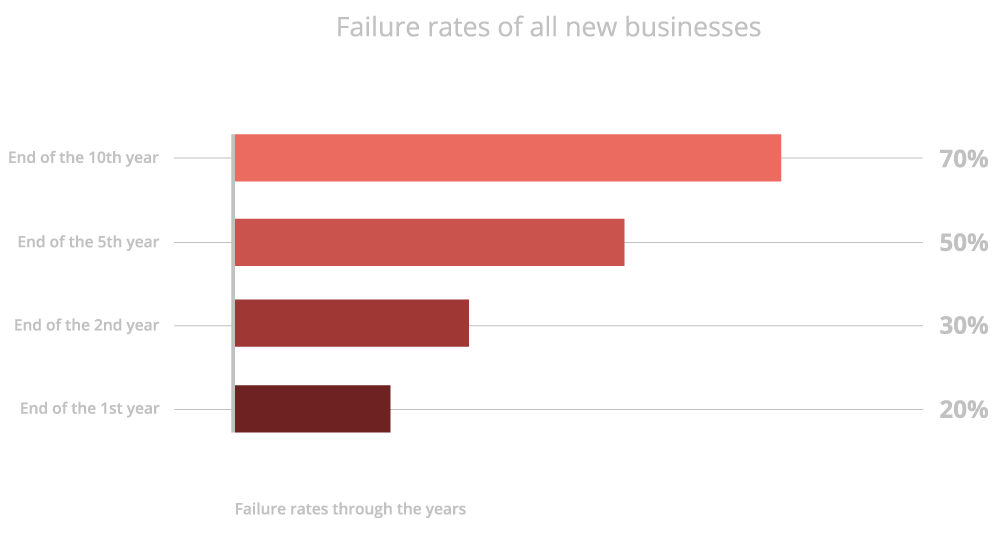

For those unaware, investing into startups is risky. According to Failory, by year five 50% of startups will fail. By year ten that percentage increases to 70%.

Compounding the above, of the companies that do not fail, only around half go on to achieve a successful exit.

Selecting the winners is clearly a difficult business. However, despite the risk there is a strong body of evidence that supports the inclusion of venture capital in a broader portfolio.

How venture capital can improve portfolio performance

The right fund, the right returns

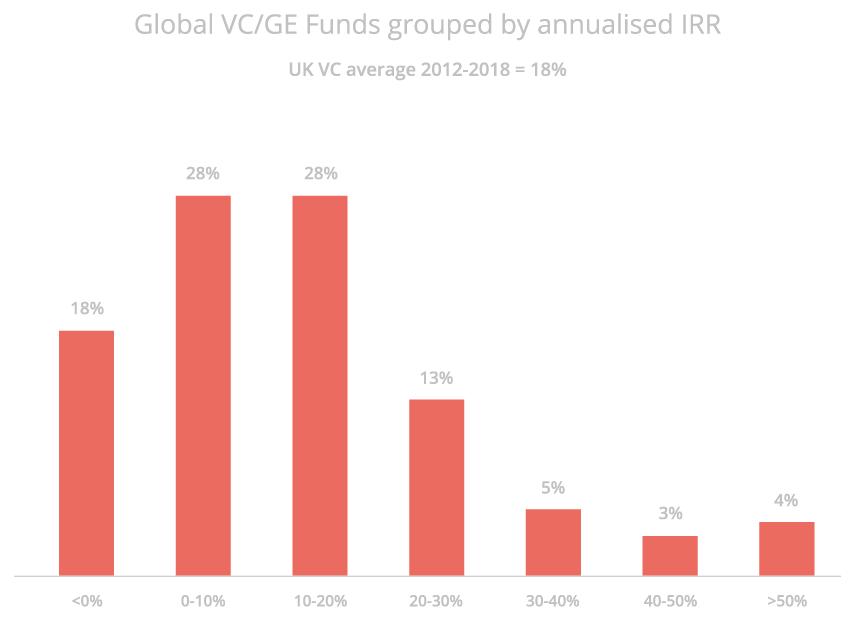

As with any type of fund, not all VC funds are created equal. But choose wisely and you shall be rewarded with the potential for above market returns. While the British Venture Capital Association (BVCA) has found that the average IRR for venture capital is 18%, we know that this is a highly skewed figure.

The graph above uses data produced by the British Venture Capital Association (BVCA). Incredibly we found that 46% of VC funds hit an IRR of less than 10%. What’s more, nearly 85% of funds underperform the average startup market return which stands at 28% IRR.

But on the brighter side, almost 70% of VC firms achieved an average IRR higher than that of the FTSE 100. In fact, the Thomson Reuters Venture Capital Research Index has found that venture capital has returned 19.7% per year since 1996 – as compared to 7.5% and 5.9%, respectively, for public equities and bonds.

Private vs public markets and diversification

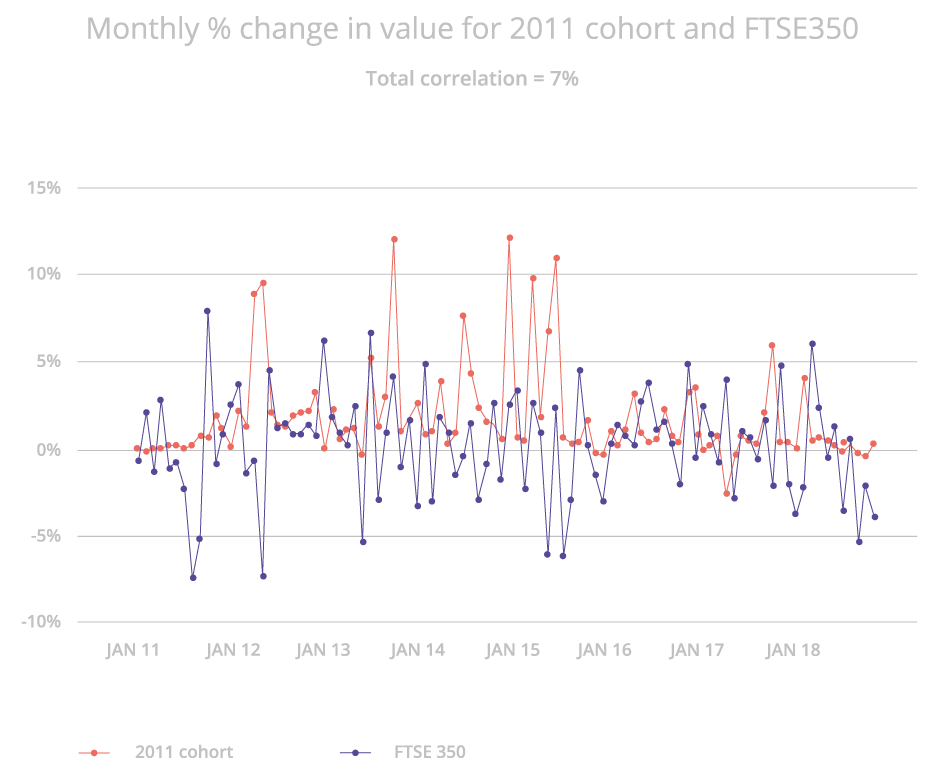

A second advantage of investing in venture capital is the element of diversification it adds thanks to the negative correlation between private and public markets.

Our data analysis comparing the performance of the FTSE 350 and our startup index found that the total correlation between the two was a mere 7% (.07) indicating no correlation between the two. Given the long term nature of VC investments the swings in public markets have little long term impact on private markets.

Given this lack of correlation, including a VC position in a portfolio that does not presently have one adds a high level of asset diversification. But how much of one’s portfolio should be in VC?

How to balance a portfolio for this risk

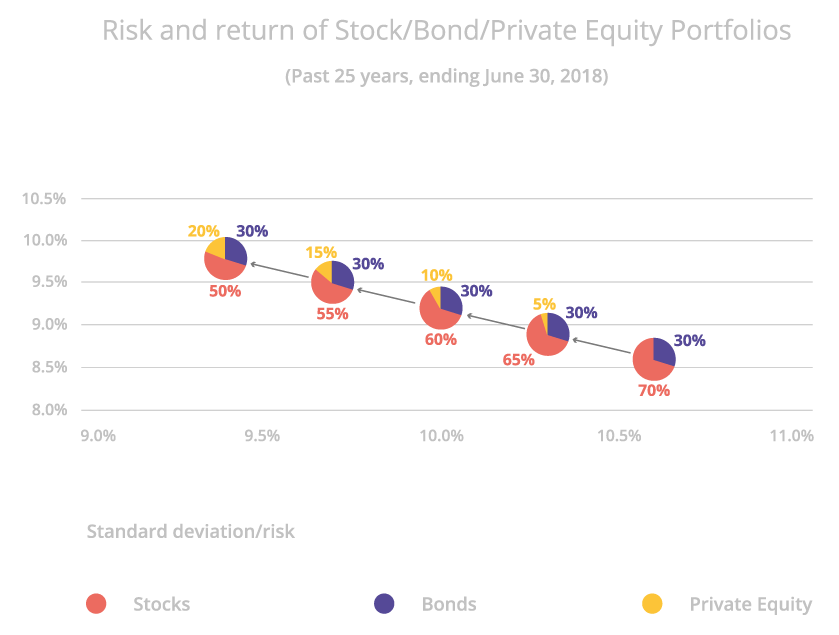

There are many arguments for including VC in your broader portfolio, but the big question is just how much of your portfolio should be allocated to VC? Many firms have researched the topic and come to similar conclusions. One thing to note, in addition to the increase in portfolio return, including VC in a portfolio has also been shown to reduce overall portfolio risk.

Neuberger Berman first looked at the topic in 2019 and identified the changes to portfolio risk and annualised returns when allocating 5%, 10%, 15% and 20% of your portfolio to private equity (the class to which venture capital sits). At 20% allocation the portfolio risk has reduced from a little over 10.5% to just under 9.5% while the annualised return has increased from around 8.5% to nearly 10%.

Source: Investment Quarterly. Private Equity and Your Portfolio. Neuberger Berman. January 24, 2019

Research by Hardman & Co. had similar findings to Neuberger Berman. In their white paper researcher Brian Moretta found that investors with normal risk profiles (equity:bond portfolios that are between 60:40 and 80:20), who add an appropriate proportion of venture capital (10-20%) can add 0.5-1% to expected annual returns without increasing overall portfolio risk, even without any tax reliefs. Long term, these small percentages add up.

The most accessible VC funds on the market

Unfortunately the minimum investment size for a large number of venture capital funds is quite high, usually starting at about £25,000. The Access EIS fund is an exception to the rule, with a minimum investment of £5,000. We understand that many investors are looking for a way to include venture capital investment in an existing portfolio, and that keeping the minimum investment requirement low means more people can add VC and diversify their holding. Of course, investors can always invest a greater amount, depending on what proportion of VC they would like to add to their portfolio.

For that initial £5,000, we build our investors a portfolio larger than any other fund on the market, because our approach is built around optimising return potential. Because venture capital returns follow a power law distribution – a small number of companies are responsible for a large proportion of the overall returns – it is important to build portfolios that are large enough to increase the chances of including some of that small minority who will generate significant returns. Most funds will build you a portfolio of 10-15 companies, we build you a portfolio of 50.

How do we select our deals? We only invest in companies that have been brought to us by experienced angel investors with a proven track record of successful investments, are experts at due diligence, and know how to identify legitimate companies that have the potential for scalability and long term growth. Does this mean all of our companies will succeed? Of course not - however much potential a company has, there is no way to know if they will stand the test of time and achieve its growth goals. But with a large portfolio, any losses represent a smaller proportion of your overall holding. And don’t forget, it might only take one company achieving a successful exit for you to potentially achieve a return on your investment of several multiples.

The Access EIS Fund

Our fund co-invests with proven angel investors to build large portfolios of hand-picked companies for our investors. It’s a high risk investment, and we can’t guarantee that every startup will be a unicorn, but we’re confident that our approach is the smartest on the market. Even better, we can show you the data to prove it.

If you’re interested and would like to find out the benefits of investing towards the start of the tax year, you can call us on 01223 478 558 and we'll be happy to answer any questions you might have.

Or, if you're ready to get started, click the button below:

Please note: our office hours are weekdays, 9.30am - 5.30pm.