In the second of our series of articles based on our whitepaper, we look at why gaining access to the top 20% of the startup market is important and how Access EIS goes about it. You can read the first in the series, where we talk about the importance of portfolio sizes, here.

Why do most funds focus on a small number of companies?

A majority of people accept that startups follow a power law distribution. 40% of startups fail within five years, and it’s within the top 10% of companies that you’ll find returns greater than 10X. Our own analysis also supported this power law, showing growth of 10X or greater in just 7.5% of the population.

This distribution, with high growth in a small concentration of companies, is the reason many VCs look to focus their capital on a few selected deals. However, with this approach there is a lot of pressure to pick winners. As we explored in our previous article, this is by no means a precise science.

How critical is access to that top 10% of deals?

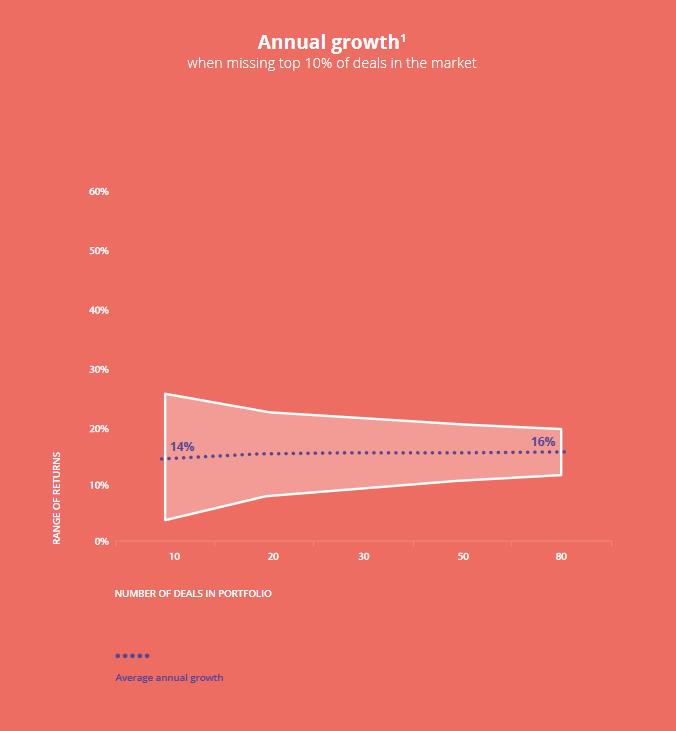

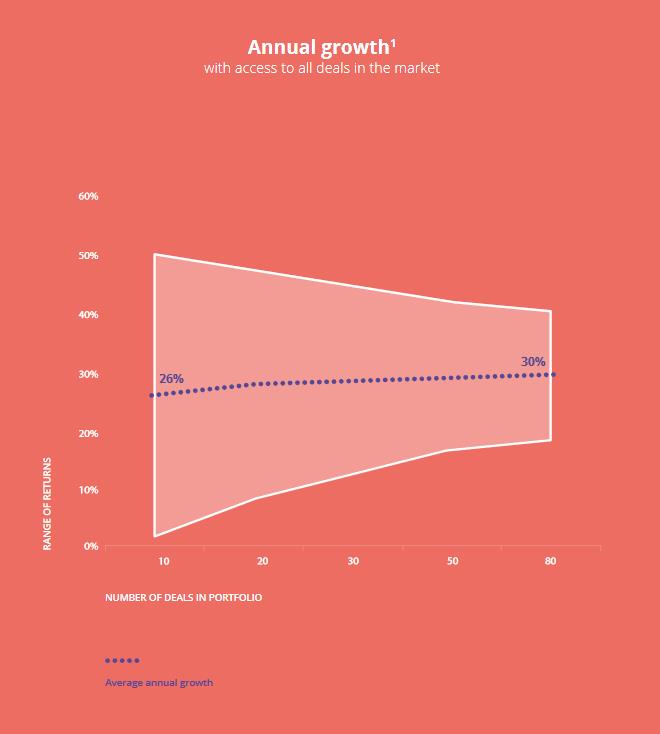

Our analysis showed that removing the top 10% of deals in the market cuts average annual growth roughly in half.

Growth still increases with portfolio size however, and with a portfolio size of 30 companies, you’d still see growth of around 16%, which is still a respectable figure by comparison with most UK VCs. But with access to the top 10% of deals, a portfolio of the same size would see around 30%.

Building the Access machine

In order to set up a fund to access the best deals, three things are needed. Firstly, make your fund as accessible as possible to founders, so you don’t end up excluding top companies with high fees, or complicated processes. Secondly, connect with the right networks. The venture market is an interconnected system of nodes, like any other network. With the right approach, you can ensure you are connected with the nodes that have access to the top end of the market. Thirdly, make your value proposition to startups as compelling as possible. Our research showed that most early-stage companies just want to get on with running their business, so we follow the straightforward capital approach.

For our fund, Access EIS, we used a large dataset to build the track records of thousands of angel investors in order to identify those with access to the best deal flow. We assembled a subset of investors whose average year on year portfolio growth was around 42%, and could be consistently shown to exceed annual market growth over at least five years. In addition, our angels are required to have a startup portfolio valued at over 100k, including at least one company that has achieved 5X growth. We established a series of conditions that needed to be met before we co-invested, one of which was to ensure that any investment fit with their general investing behaviour.

We now co-invest with these key angels in order to gain access to their high quality deal flow. In return, they gain fast, cheap capital, and further connectedness to the best deals through the other angels in our network.

Visit our website to find out more about our fund, Access EIS.

Please note: our office hours are weekdays, 9.30am - 5.30pm.