In June, SyndicateRoom added six new startups to the Access EIS portfolio, investing alongside super angels in each case (for more on our super angels, and our co-investment model, see our dedicated page). Find out more about our fund, Access EIS, or read about our new portfolio companies below.

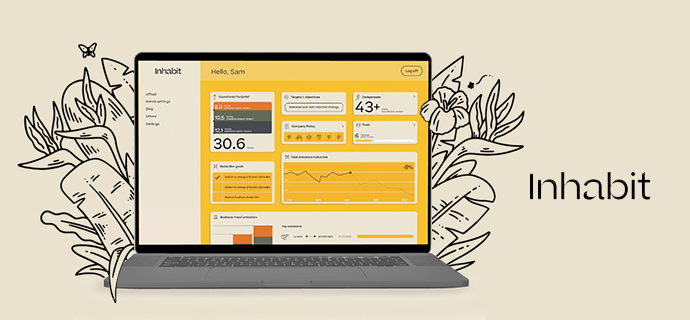

Inhabit

From the breakdown of Operational Carbon Footprint to major emissions, Inhabit helps businesses accurately measure their climate impact then builds them a customised reduction plan to meet their goals. Its tool, the Active Climate Toolkit, allows users to set targets, plan scenarios, and prioritise actions, then produce and publish reports and policy documents. It emphasises actionable plans that focus on the most important things first, and provides credible offsetting projects where reductions aren't possible.

Our angel partner in the round has a weighted IRR of 47% and has invested in Zynstra, Magic Pony and Flyt, to name a few.

Total Round: approx. £1,700,000.

Stage: Pre-revenue.

Peazi

Peazi is the only order and pay solution with no download and no sign-up necessary. Its mobile ordering system combines ease and speed with a personalised waiter service, so customers can order, eat, drink and pay with no fuss. It can be branded bespoke to any business, and uses ai to suggest good combinations of food and drinks to make sure your customer doesn't miss out.

Our angel partner in the round has a weighted IRR of 37% and has invested in Novastone, ScreenCloud, and RotaGeek, among others.

Total Round: approx. £500,000.

Stage: Post-revenue.

Clerkenwell Clinics

Clerkenwell Clinics provides bespoke services to drug developers for trials from preclinical to Phase III. It has an intimate understanding of regulatory, legal, research and clinical trial set-up and management requirements, and counts a dominant share of the psychedelic speciality talent pool, leading clinical subject experts and globally recognised opinion leaders among its team members. This uniquely positions Clerkenwell Health to accelerate and partner with psychedelic drug developers to bring life-changing mental health treatments to patients with high unmet clinical need.

Our angel partner in the round has a weighted IRR of 126% and has invested in Adzuna, Tandem, and VouchedFor, among others.

Total Round: approx. £1,500,000.

Stage: Post-revenue.

Lumi Network

Lumi's enquiry-based programme gives students autonomy over their direction of study as they tackle the most complex issues facing mankind. Guided by a team of engaging Illuminators, Luminaries between the ages of 10 and 17 from every corner of the globe are introduced to the world of coding and develop a whole host of skills that they will carry with them for a lifetime.

Our angel partner in the round as a weighted IRR of 64% with previous investments including Atom, Monese, and Smart, to name a few.

Total Round: approx. £1,000,000.

Stage: Post-revenue.

Connectd

Connectd empowers the early-stage ecosystem to make and manage meaningful connections. Through its proprietary reporting suite, portfolio management system and smart match technology, Connectd is removing the friction that hinders growth for founders, investors and startup advisors.

Our angel partner in the round has a weighted IRR of 37% and has invested in Novastone, ScreenCloud, and RotaGeek, to name a few.

Total Round: approx. £1,500,000.

Stage: Post-revenue.

Beeline

Beeline has created a smart compass and app system that guides cyclists and motorcyclists to their destination, making cycling safer and more accessible to more people.

Our angel partner in the round as a weighted IRR of 64% with previous investments including Atom, Monese, and Smart, to name a few.

Total Round: approx. £400,000.

Stage: Post-revenue.

Please note: our office hours are weekdays, 9.30am - 5.30pm.