Belfast-based Re-Vana Therapeutics, a SyndicateRoom portfolio company, has announced a transformational strategic collaboration with global pharmaceutical leader Boehringer Ingelheim, marking a landmark moment for both the Northern Ireland biotech company and the UK's life sciences sector. The partnership, with a potential total deal value exceeding $1 billion for the initial three targets plus royalty payments on net sales, aims to develop revolutionary extended-release therapies for eye diseases.

Re-Vana's drug delivery technology is designed to release treatments slowly over six to 12 months, aiming to drastically reduce how often patients need injections. This breakthrough approach addresses one of the most burdensome aspects of treating serious eye conditions such as macular degeneration and diabetic retinopathy, where patients currently require frequent, painful injections directly into the eye.

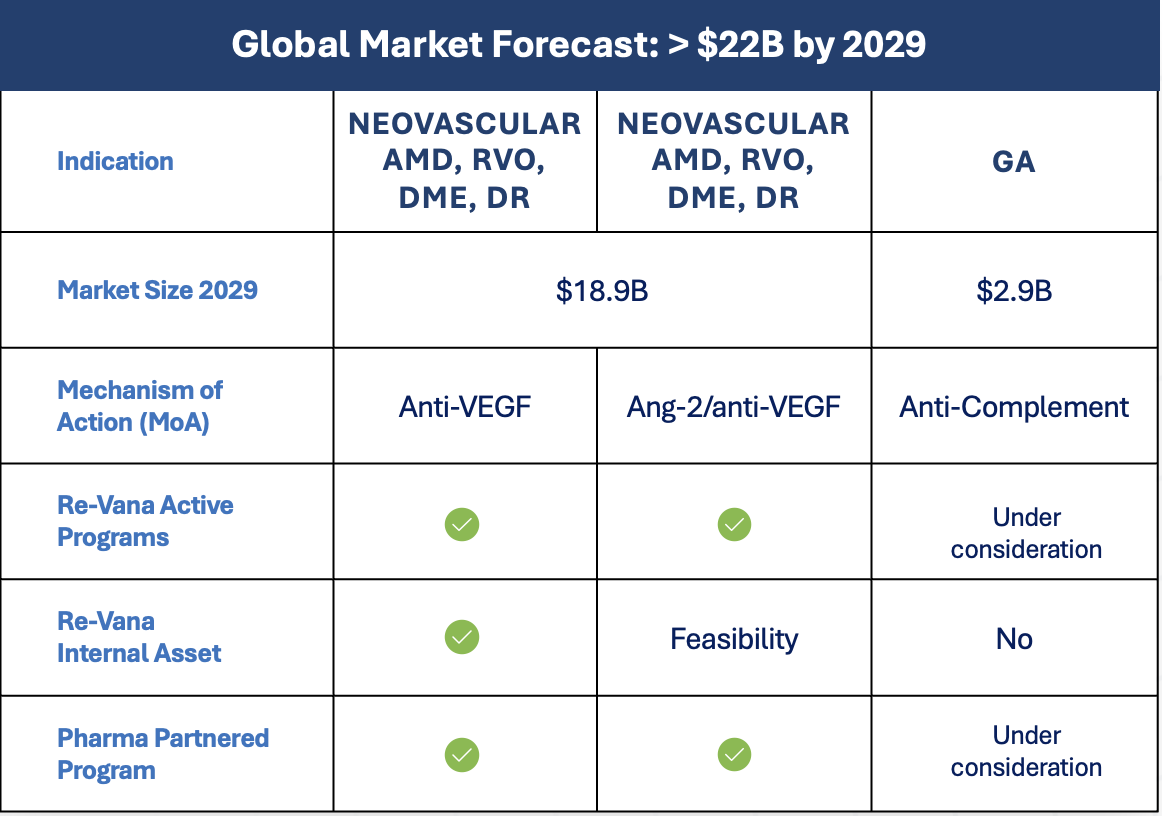

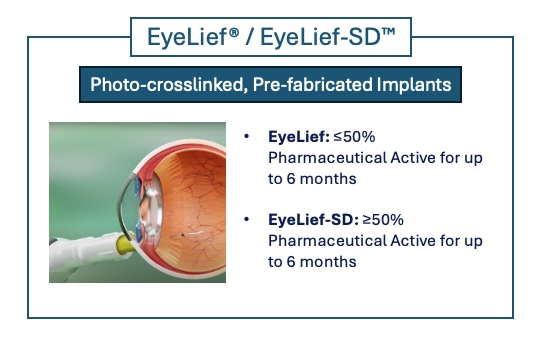

The company's proprietary technologies, EyeLief®, EyeLief-SD™ and OcuLief®, enable custom delivery of a wide range of therapeutic molecules through photo-crosslinked, biodegradable platforms. These innovative systems can deliver biologics and small molecules for periods ranging from six months to over a year, potentially transforming the treatment landscape for millions of patients worldwide facing vision loss.

Under the collaboration, Boehringer Ingelheim aims to add up to three projects per year across therapeutic modalities. The companies will jointly oversee Re-Vana's feasibility and development activities for the extended-release programs, with Boehringer Ingelheim assuming sole responsibility for clinical development, regulatory approval, and global commercialisation of the products.

Re-Vana Therapeutics Ltd, founded in 2016 as a spin-out from Queen's University Belfast, is an ocular therapeutics and innovative ocular drug delivery company based in Belfast, Northern Ireland. The company has established itself as a pioneer in sustained-release ophthalmic therapeutics, developing solutions that promise to significantly reduce the treatment burden for patients with sight-threatening conditions.

Re-Vana's vision is to create a new industry standard for sustained delivery of biologics to the retina, developing transformative and differentiated treatments for physicians whilst significantly reducing patient treatment burden. The company's approach has attracted backing from leading ophthalmic investors, demonstrating strong confidence in both the technology and market opportunity.

SyndicateRoom is listed among Re-Vana's lead investors, demonstrating our commitment to supporting breakthrough technologies that address significant unmet medical needs.

SyndicateRoom's products have invested into over 250 startups across six funds and counting, deploying over £77 million into these startups. Our Access EIS fund builds diversified portfolios of up to 30 companies for individual investors, co-investing alongside leading angel investors. Past performance is not a reliable indicator of future results.

This strategic approach has enabled our investors to access some of the UK's most promising startups across multiple sectors. Our data-driven, sector agnostic portfolio gives investors access to exciting companies via our network of angel co-investors.

From climate tech pioneers to cutting-edge healthcare innovators like Re-Vana, SyndicateRoom's funds provide investors with exposure to companies that are not just building successful businesses, but are actively solving some of society's most pressing challenges.

Our Access EIS Fund is the most diversified EIS product currently available to UK investors, building portfolios across sectors. This diversification is crucial in venture investing, where the power law distribution means that a small number of exceptional companies generate the majority of returns. We also operate the Carbon13 SEIS Fund, which focuses on innovative climatetech startups, and the Angel Academe Fund, the UK’s first fund focused on female-founded businesses.

Our focus remains on building portfolios of genuinely exceptional companies that can deliver strong returns, while offering investors access to EIS and SEIS tax reliefs.

For investors seeking exposure to the next generation of breakthrough companies, SyndicateRoom offers unparalleled access to the UK's most promising startups. Our combination of data-driven selection, experienced co-investors, and comprehensive diversification provides an optimal framework for venture capital investing.

Find out more about our funds currently open to investment:

Access EIS: Large portfolios, data-driven co-investment with leading UK angels

About SyndicateRoom: SyndicateRoom is a fund manager authorised and regulated by the Financial Conduct Authority, specialising in tax-efficient investments in high-growth UK startups. Through our Access EIS and specialised funds, we provide investors with diversified exposure to innovative companies across multiple sectors.

Please note: our office hours are weekdays, 9.30am - 5.30pm.