Traditional pensions may no longer be the most tax-efficient way to save for retirement. Where UK taxpayers once enjoyed a £255,000 allowance for HMRC pension contributions, this was reduced in 2017/2018 and is now only £40,000.

By contrast, EIS investments offer reliefs on income tax, capital gains tax, inheritance tax, and several deferral options to eligible investors, in addition to the chance for returns. They also allow investors to claim tax reliefs on investments of up to £1m per year, which rises to £2m if the investments are made into "knowledge intensive." businesses. Simon Ruthers, Director of Business Development at Oxford Capital, suggests that these benefits, along with the reduction in the pension allowance, could be what’s behind the growing interest in EIS schemes.

What is EIS, and what are the benefits?

The Enterprise Investment Scheme (EIS) is a government initiative established in 1994 to incentivise investment in British startups, either directly or via venture capital funds. In addition to the chance of sizeable returns, albeit at high risk, a key incentive is a suite of generous tax reliefs and deferral options on invested funds.

It offers investors a generous 30% income tax relief on the amount invested into a fund as well as loss relief on the investments that fail that can bring an investor’s total investment exposure down to around just 30% of their initial investment. Therefore, on a £5,000 investment, once all tax reliefs are taken into consideration, an investor may only be at risk for around £1,500.

Should that not be enough, there are no capital gains to pay at exit on profits generated from shares held for a minimum of three years and no inheritance tax is paid on shares held for a minimum of two years as EIS investments qualify for Business Investment Relief (BIR)

Get your free guide to EIS

Want more information on EIS tax reliefs?

Download your copy of our free guide. Featuring an analysis of UK investor trends, investment case studies and an EIS cheat sheet.

TL:DR?

1. 30% income tax relief on the amount invested, and the option to apply tax relief to the previous tax year.

2. No capital gains tax on disposal.

3. Capital gains tax deferral relief.

4. Inheritance tax relief, specifically an exemption after two years through business property relief.

5. The chance of loss relief for companies that fail.

Innovations in fund management technology and demand have led many EIS funds to lower the entry ticket for their funds, opening the door to a much broader investor base. In fact, some funds have minimum investments starting at £5,000.

Should you add EIS investments to your portfolio?

Possible downsides: risk.

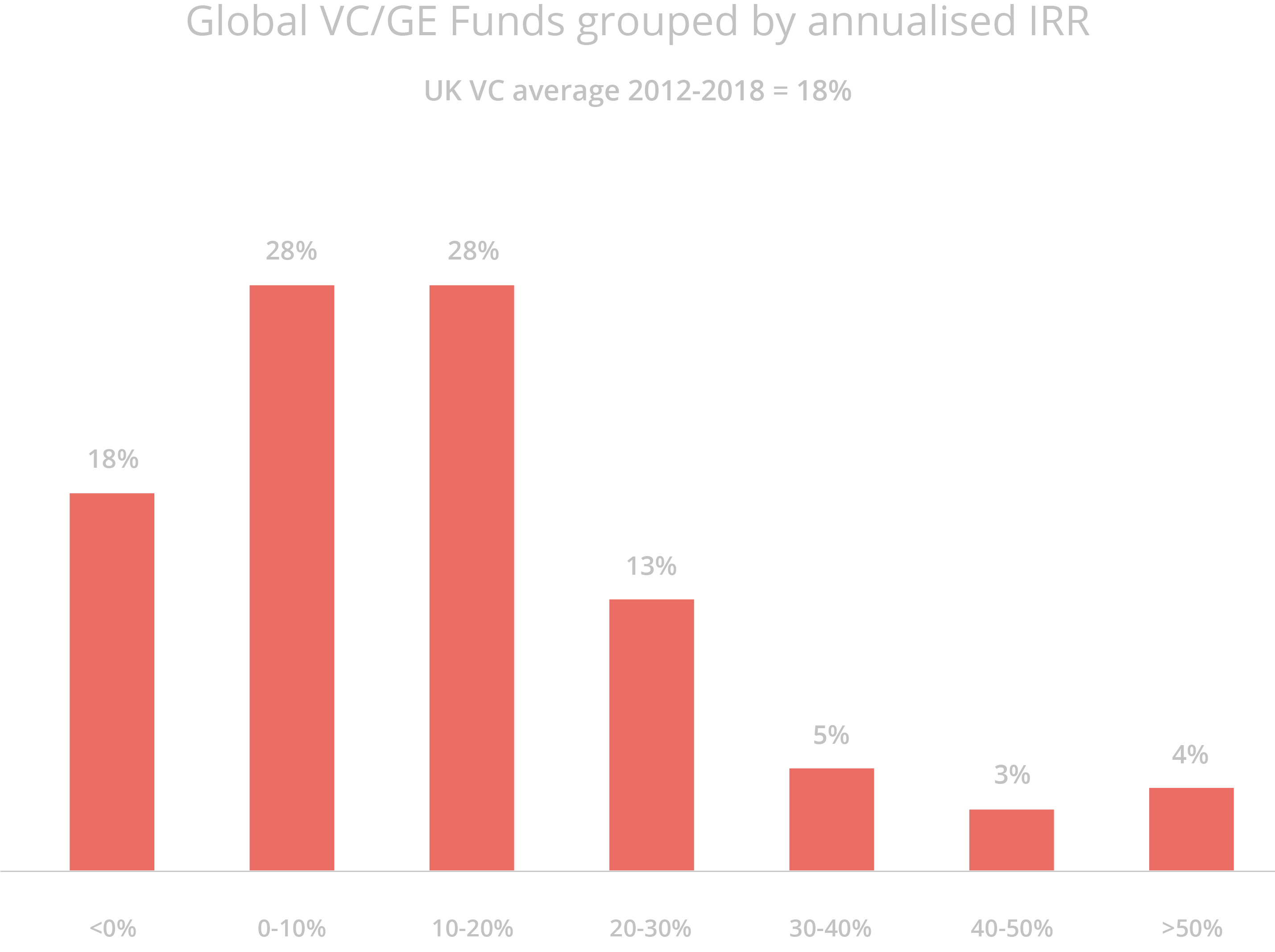

Before making a decision, it’s useful to know the risks. Data from the British Venture Capital Association (BVCA) found that 48% of VC firms hit an IRR of less than 10%. What’s more, nearly 85% of firms underperform the market return which stands at 28% IRR.

In many cases, venture capital funds will create smaller portfolios in an attempt to focus investment on those companies they feel have the best chances of success. However, because it is extremely difficult to predict the success of startups, this approach actually misses the opportunities offered by spreading investment risk across a larger portfolio. Combined with a lack of liquidity and a 10-year+ holding period, one might question if the risk of including VC in your portfolio is worth the potential return.

It’s not all bad though: diversification.

There is hope and it rests in creating more diverse portfolios. Borrowing lessons from the public markets and modelling out historical returns based on portfolio sizing, it appears that creating a portfolio of 50+ companies can improve the likelihood of achieving the 28% IRR of the market considerably. So, while a £5,000 additional investment into your ISA may slowly grow itself into around £8,000 (using a 5% compound growth rate) over a 10-year period, the same £5,000 investment into a fund hitting 28% IRR would net you several times that figure.

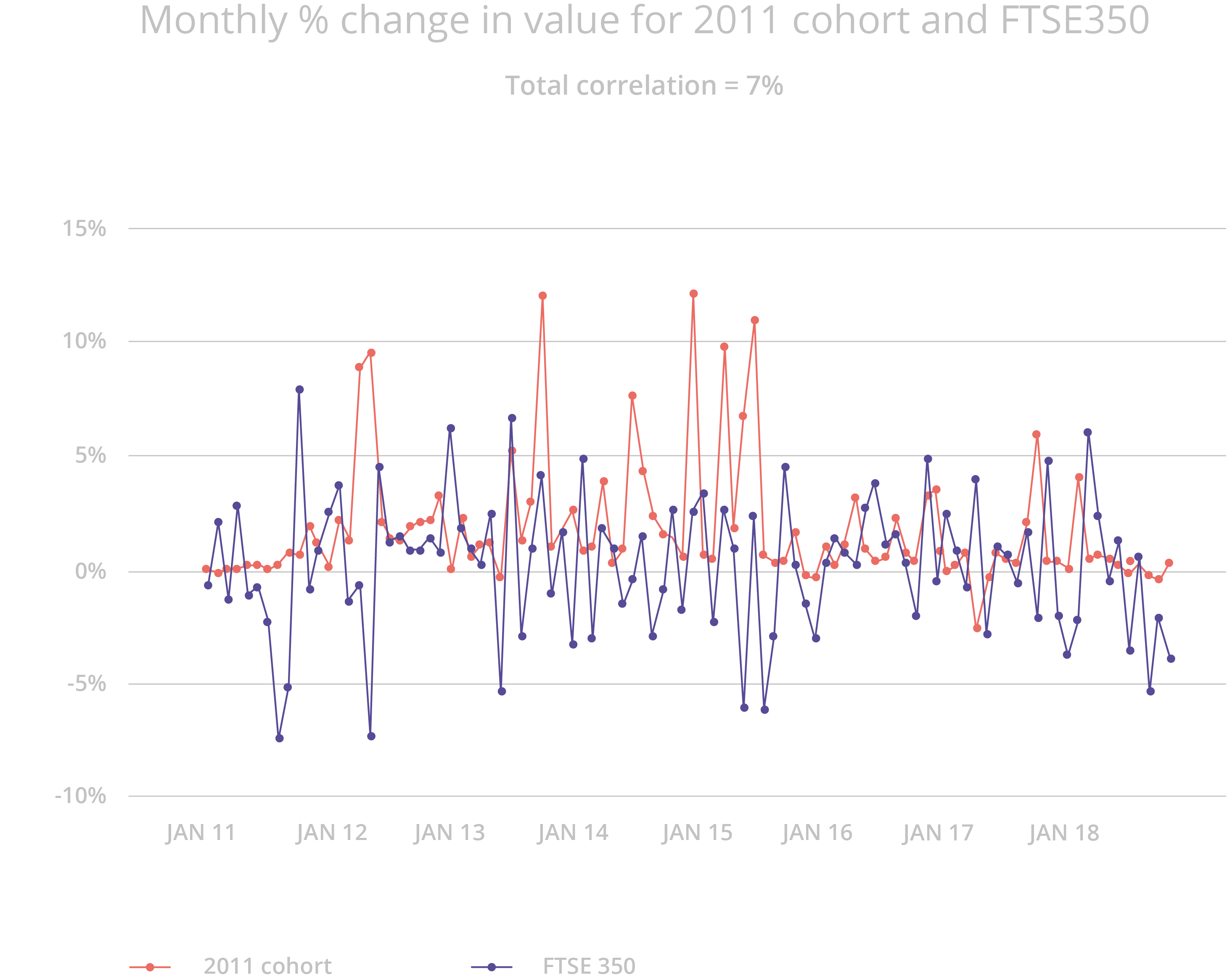

What’s more, data analysis comparing trends of public and private markets over the last 10 years has shown a low correlation between public and private market investments. Therefore, adding VC to a broader portfolio brings a new dimension of diversification that is not achievable through only holding publicly traded companies and funds that focus on listed markets.

Data-driven, accessible venture capital: the Access EIS fund.

If you’re looking for a fund with a relatively low minimum investment (£5,000), a large portfolio of 50+ companies for each individual investor, all the tax relief options that come with EIS and an innovative investment model – it co-invests with expert angel investors with an average IRR nearly double that of the market – one option worth looking at is the Access EIS fund, operated by SyndicateRoom. It was recently ranked among the most active venture capital funds in London (Beauhurst, 2021), and is definitely worth a look if you’re exploring options for retirement planning and want to start with a modest outlay. They have a very approachable team, who are happy to answer any queries you may have over the phone.

Please note: our office hours are weekdays, 9.30am - 5.30pm.