The UK Autumn Budget, scheduled for November 26, 2025, is widely anticipated to feature tax rises, driven by a challenging economic outlook and the need to address a multi-billion-pound fiscal shortfall. The Chancellor has reportedly indicated that higher taxes on the wealthy will be "part of the story,” and her pre-Budget speech on 4 November did nothing to dispel these expectations.

The government has pledged not to increase the headline rates of Income Tax, National Insurance, or VAT for "working people. Therefore, speculation focuses on other areas of the tax system, often targeting assets and wealth.

What are the expected tax changes and rises, who will be most affected, and what should investors be doing now to offset the incoming changes? Read on to find out.

Please note the below are based on speculation, and are not guaranteed.

Expected Tax Changes and Rises

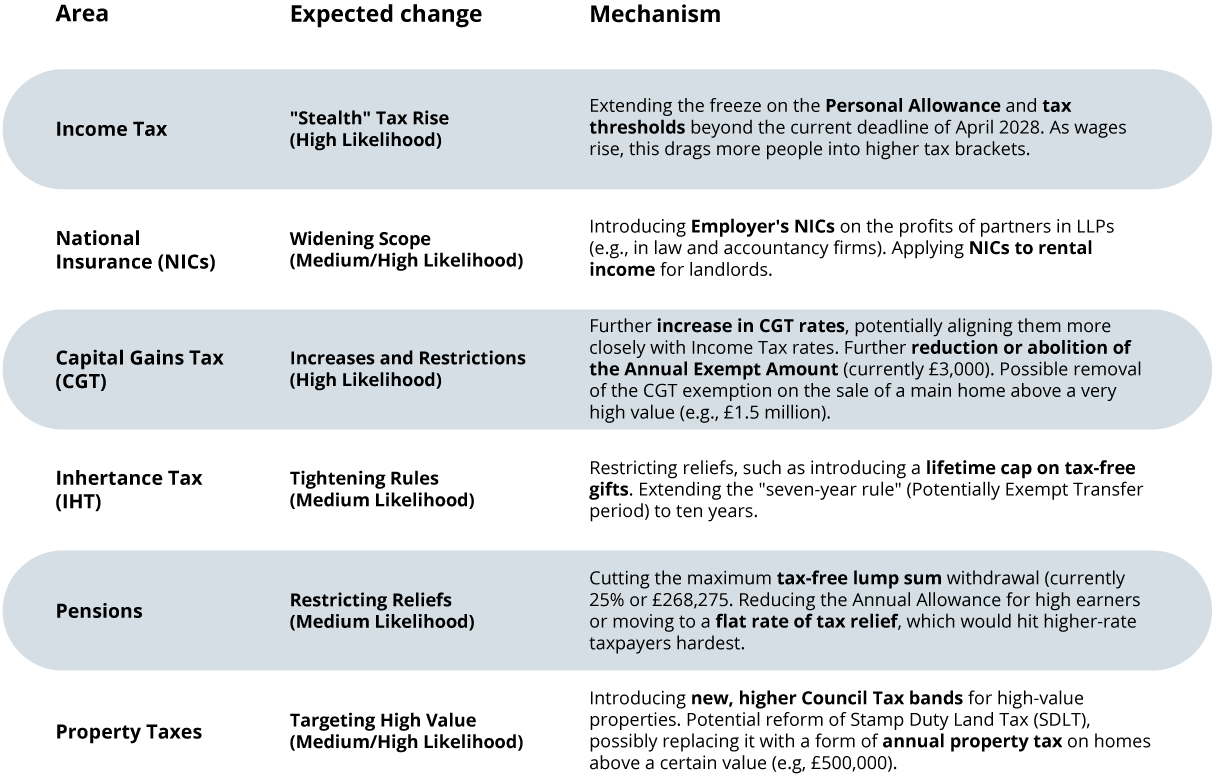

Below are the most frequently rumoured tax changes, with the expected tax rise mechanisms:

How will this affect wealthy people and investors?

The potential measures are largely targeted at wealth and assets rather than just earned income, meaning they would disproportionately affect high-net-worth individuals and those with significant investments or property portfolios.

Capital Gains and Investment Income: Aligning CGT rates with Income Tax and further cutting the annual allowance would mean a significantly higher tax burden on the sale of shares, secondary properties, and other investments.

Business Owners and Professionals: The proposed introduction of Employer's NICs on LLP profits would directly increase the tax liability for partners in many professional services firms.

Property Owners: Changes to property taxes, such as new Council Tax bands, a potential annual property levy, or applying CGT to high-value main residences, would increase the annual and disposal-related costs of owning expensive homes.

Estate Planning: Any restriction on Inheritance Tax reliefs, such as a lifetime cap on gifts or extending the seven-year rule, would make it harder and more expensive to pass on wealth tax-efficiently.

Pension Savings: Reductions in the tax-free lump sum or moving to a flat rate of tax relief would make pension contributions less attractive for higher and additional rate taxpayers.

To summarise, the focus appears to be on generating revenue by broadening the tax base and restricting existing tax reliefs and allowances, which tends to impact those with capital assets and higher incomes the most.

What measures can investors take to get ahead of the tax changes?

In the face of expected tax rises, particularly those targeting wealth, capital gains, and high earners' reliefs, proactive tax planning becomes crucial.

The strategy is to maximise the use of existing statutory tax-advantaged wrappers and reliefs before the Budget, as changes could be implemented immediately or announced with effect from the start of the next tax year (6 April 2026).

Here is an explanation of the key measures available to investors and savers:

1. Invest in EIS: 30% income tax relief, inheritance tax relief and defer capital gains

Investing in early-stage startups that are eligible for EIS grants investors access to a number of extremely attractive tax reliefs, in addition to the potential for significant returns from the investment itself.

While investors can choose to invest in individual companies, investing in an EIS fund that will build you a diverse portfolio of companies, screened and selected by an experienced manager, is recommended.

Tax reliefs are subject to status and change. Tax reliefs include:

Up to 30% income tax relief - applicable to the current tax year or the year prior.

Significant allowance – up to £1 million per tax year (or £2 million if at least £1 million is in knowledge-intensive companies).

Capital gains tax free disposal of EIS shares.

Capital gains deferral – defer capital gains realised up to 12 months before or three years after your investment, for as long as you hold your EIS shares.

Loss relief – offset any losses against income tax or capital gains tax.

Inheritance tax relief – IHT exemption of EIS shares held for more than two years.

For current EIS investment opportunities with SyndicateRoom, see the Access EIS Fund. This is the UK’s most diversified fund. It co-invests with leading UK angel investors to build you a large portfolio of high-potential startups across all sectors, and maximise your return potential.

2. Invest in SEIS: 50% income tax relief, 50% capital gains tax relief, inheritance tax relief and more.

Investing in seed-stage startups that are eligible for SEIS grants investors access to some of the most significant tax reliefs available, in addition to the potential for significant returns from the investment itself.

While investors can choose to invest in individual companies, investing in an SEIS fund that will build you a diverse portfolio of companies, screened and selected by an experienced manager, is recommended.

Tax reliefs are subject to status and change. Tax reliefs include:

The Seed Enterprise Investment Scheme grants investors access to the following tax reliefs:

Up to 50% income tax relief – applicable to the current tax year or the year prior.

Significant allowance – £200,000 per tax year.

No capital gains tax payable on disposal of SEIS shares.

Up to 50% capital gains reinvestment relief – cut a separate capital gains tax bill from the year of your investment in half.

Loss relief – offset any losses against income tax or capital gains tax.

Inheritance tax relief – IHT exemption of EIS shares held for more than two years.

For current SEIS investment opportunities with SyndicateRoom, see the climatetech-focused Carbon13 SEIS Fund, managed in partnership with expert climatetech venture builder, Carbon13. This fund invests in cutting edge climatetech innovations built by a hand picked cohort of founders that have graduated from Carbon13’s venture builder programme.

3. Invest in Venture Capital Trusts (VCTs)

VCTs allow investors to pool money in a listed vehicle that invests in small, unquoted trading companies.

Relief: 30% Income Tax Relief on investments up to £200,000 per tax year.

Benefit: Tax-free dividends and CGT exemption on disposal. This is a powerful shield against a potential future rise in Dividend Tax or CGT.

4. Use Individual Savings Accounts (ISAs) to get around capital gains tax.

ISAs are the cornerstone of tax-free investing, as all income and gains are protected from Income Tax and CGT. This is the primary defence against a CGT rate rise.

Maximise your £20,000 annual ISA allowance (for the current tax year) as a matter of urgency. The government has already signalled a desire to encourage investing over cash savings, and there is speculation that the cash ISA allowance may be cut in the future to push funds into Stocks and Shares ISAs.

'Bed and ISA' Strategy: Sell investments (like shares) currently held outside an ISA, use the CGT Annual Exempt Amount (£3,000) to realise a gain tax-free, and then immediately buy the same investments back within your ISA wrapper.

Please note, this does not constitute tax advice. Please consult a financial adviser before making any investment decisions.

Please note: our office hours are weekdays, 9.30am - 5.30pm.