Please note: our office hours are weekdays, 9.30am - 5.30pm.

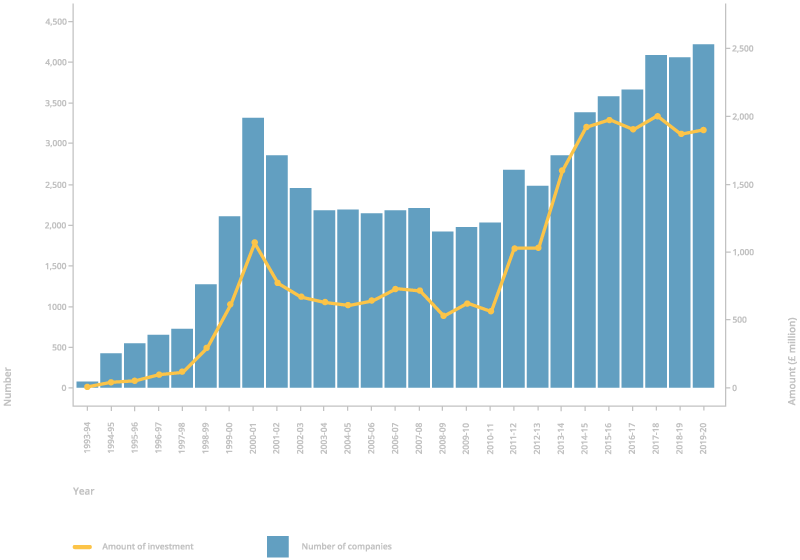

An EIS investment is an investment that an investor, or fund, makes into high growth Enterprise Investment Scheme qualifying companies. Each year in the United Kingdom nearly £2 Billion is invested into EIS eligible companies.

Investing in EIS is considered high risk. The companies that qualify for investment are younger companies with less of a track record than a publicly listed firm. These are long term investments focused on on capital growth. Companies take many years to develop to the point that they are ready to exit and dividends are not likely.

While high risk, some companies and EIS funds return many multiples on their initial investment. For example, the angels who first invested in Zoopla in 2009 received almost 100x in return when it floated on the stock exchange in 2014. This kind of success story doesn’t happen every day, but it is possible.

The potential impact of these investments is also something to consider. The companies create jobs, progress research, innovate, and more. Many aim to deliver a positive change to the environment or society through their product or their principles of management.

Investing through the Enterprise Investment Scheme (EIS) is a bit different to investing in a listed company on a stock market. There is no marketplace to buy or sell the shares in these startups and scaleups.

Investors can find EIS qualifying companies through in-person networks, such as angel networks or accelerators, online via equity crowdfunding platforms, or by investing through a managed EIS fund. SyndicateRoom’s approach draws on a wide network of experienced angel investors, with a proven track record of making successful investments, and co-invests in the deals they choose.

Once an investment is completed an investor can expect to wait 6-8 weeks, though sometimes longer, for the EIS certificates to arrive. These are the certificates required to claim EIS tax relief.

As companies that qualify for the scheme are generally early in their journeys, investors who back them should expect a long holding period. While some tech companies may grow fast and return capital sooner, most startups take 7-10 years to grow and some take much longer than that.

As there is no true secondary market for shares in these companies investors should expect to hold onto their shares until an exit event. This exit event may be through the company being acquired, through it listing on a stock exchange or, in most cases, by going into liquidation.

There are a few different types of investing opportunity available to you. As outlined above, an investor has the option of investing directly into individual companies, through a network or platform, or they can invest into a portfolio of companies through a fund.

The benefit of investing directly is that you get to decide which company, or companies, you wish to invest into. Companies across most sectors are eligible for EIS. You can choose to opt for companies from a single sector you know well or you can diversify across many sectors and even stages. The downside of investing direclty is that completing the recommended level of the due diligence takes time. According to the UK Business Angel Association, most successful angel investors spend a minimum of twenty hours of due diligence before investing. This due diligence includes:

meeting and speaking to the founders and members of the team

reviewing the investment documents and legals

assessing the wider market opportunity

comparing the companies products and services with competitors

speaking with other angels about the opportunity

Investing indirectly through a fund puts the onus of doing the due diligence on the fund managers and their teams. These fund managers are often very experienced investors, though you should review their track record before deciding to invest. In exchange for selecting the companies and managing the portfolio, funds charge investors fees. These fees include setup fees, annual management fees, and some form of performance fee.

With investments into our fund, Access EIS, an additional layer of due diligence is carried out on each company by the angel investors we co-invest with.

Be sure to check the fees thoroughly before you decide to invest. We work hard to keep our fees 100% transparent and reasonable, but this is not the case with all funds.

The tax benefits on offer are very generous, but before investing, investors should ensure they qualify to receive the relief. The fundamental requirement is that an investor is working and paying taxes in the UK.

If an investor does qualify, they can expect to receive the following tax reliefs:

Read more about the EIS tax reliefs.

If you are uncertain if you qualify or if you require further help we advise you to speak to a professional accountant or advisor.

Eligible Investors can claim relief on investments up to £1m to £2m per tax year. For the £2m level the investments must be into knowledge-intensive companies.

Knowledge-intensive companies are companies that are carrying out research, development or innovation at the time that they are issuing shares. They have a special status under EIS, and can raise more than non-knowledge intensive companies.

As with all investments, this will come down to your individual circumstances. The risk of early-stage investments is hard to overlook. However, if you have a small amount of capital that you can afford to lose, and you are looking to diversify your portfolio beyond mainstream investments, putting a small amount into eligible companies can be rewarding both financially and from seeing the impact the underlying portfolio companies create.

If you are worried about the risk, read more about our EIS fund which reduces the risk by diversifying across several companies and co-investing with the UK''s top angel investors. We also suggest speaking with a professional about investment or tax advice.

The information on this page does not constitute financial advice and is provided on an information basis only, based on research using the following sources: