You’ll be pleased to know that at our end, we’ve made the process as simple as possible.

Some important points to start:

- If you pay tax solely through PAYE, you will need to file a tax return in order to claim tax reliefs. You can find more about the process of registering and filing a return on HMRC's website.

- You don’t need to fill out a separate tax return for each individual investment. Once deployment is complete, you simply go to complete a return as you would for a single investment, then add the information about your Access investments we provide via your dashboard to your return (details in Step 1 below).

- You don’t need to include copies of the EIS3 for each individual investment with your tax return. But HMRC do reserve the right to request the form. We hold copies of all EIS3s on your Investor Dashboard. As our fund deploys for, roughly, a 12 month period, you will receive EIS 3 certificates into your dashboard throughout this deployment. You can begin to make claims as soon as the first EIS3 certificates appear in your dashboard, or you can wait till the end of deployment to download all of the information and make your claim in one go.

- Tax relief applies to the year in which the shares are issued, regardless of when the EIS3 form is issued. But, this can be carried back to apply to the previous tax year. This flexibility, along with the ability to invest at any time of year, is a significant advantage of so-called “unapproved” EIS funds over “approved” funds (which issue a single EIS5).

- You can only claim on capital that has been invested into businesses. SyndicateRoom deploys approximately 93.5% of all investments (before VAT).

To try to explain the process of claiming EIS tax relief through self-assessment in as straightforward a way as possible, we''ve broken the process down into the steps below.

Step 1.

1. Download the information on your investments from your SyndicateRoom [Investor Dashboard](/dashboard). (If you are not a SyndicateRoom investor, you will need to manually compile the information for each of your investments, including the UIR numbers from the EIS3 certificates and the amount invested in each company. Then go to Step 2 below)

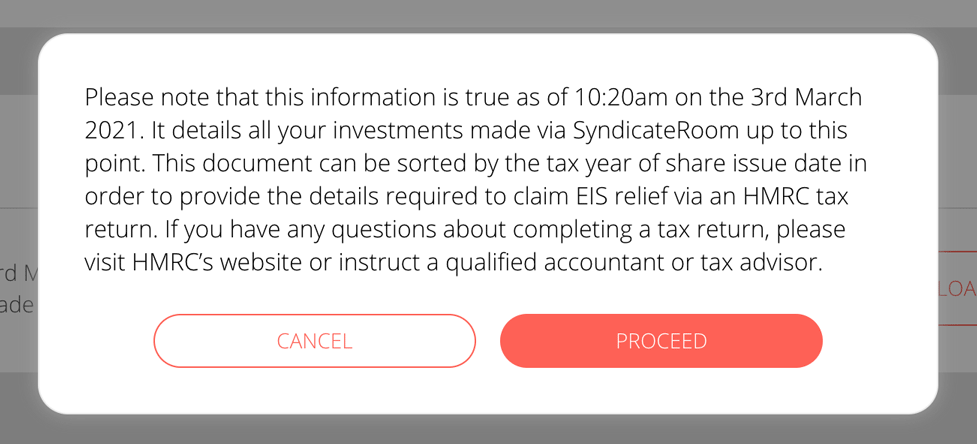

On your dashboard, click the “Download Summary Spreadsheet” button in the bottom right. That will open a message box like this:

Click the "Proceed" button, then save the .csv file to your computer.

Step 2.

Head to

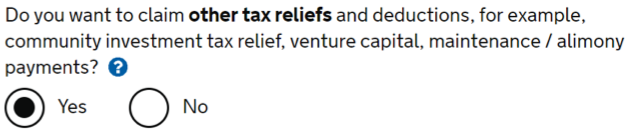

www.tax.service.gov.uk and sign in. If this is your first time completing a self-assessment form, you will need to create an account. When prompted with the question on other tax reliefs in section 3, "Tailor your return", "Do you want to claim other tax reliefs and deductions...", check "Yes"

Step 3.

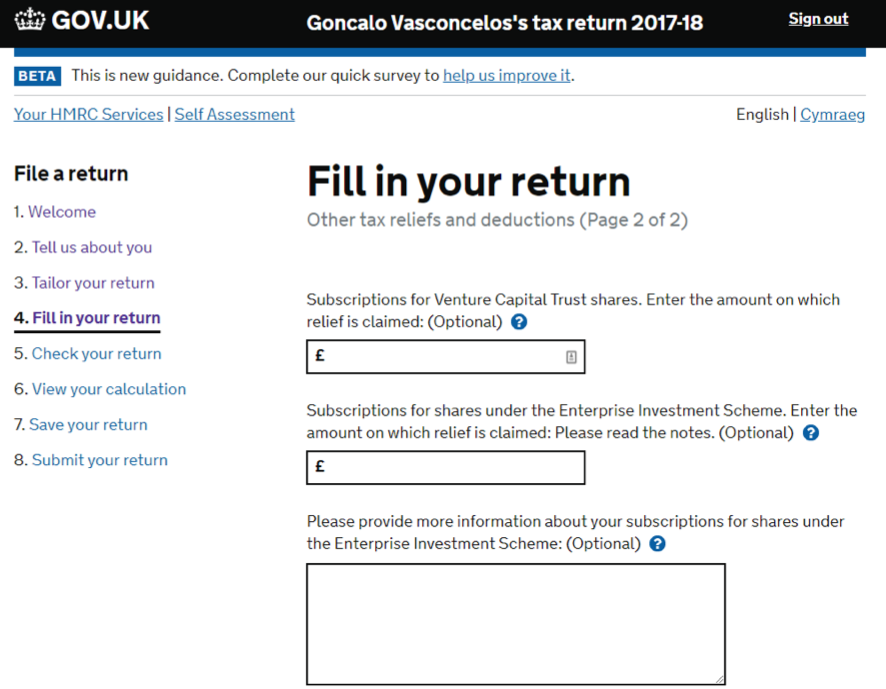

In the section "Other tax relief and deductions (Page 2)" of section 4, "Fill in your return", you will have to type in the total amount of all your EIS subscriptions on which you wish to claim tax relief and can provide details of each of your EIS investments.

Syndicate Room Investors: From the spreadsheet you downloaded from your dashboard, add up the total invested in each deal that you have a UIR number for, and for those deals with share issue dates in the year you want to claim for, and add this number to the relevant box.

Within the blank “Additional information” part at the end of this section, you should write the Unique Investment Reference (UIR), the name of the companies invested in, the amount of the subscription and the date of issue of the shares.

If you have a very large number of companies to include in this box, you can convert the .csv file you download from your Investor Dashboard into a .pdf file, and attach this to your tax return. HMRC will only accept attachments in PDF format, that are virus-free and under 5mb. Be sure to review HMRC’s

guidance on this, and verify that it is suitable to do this in your case before proceeding.

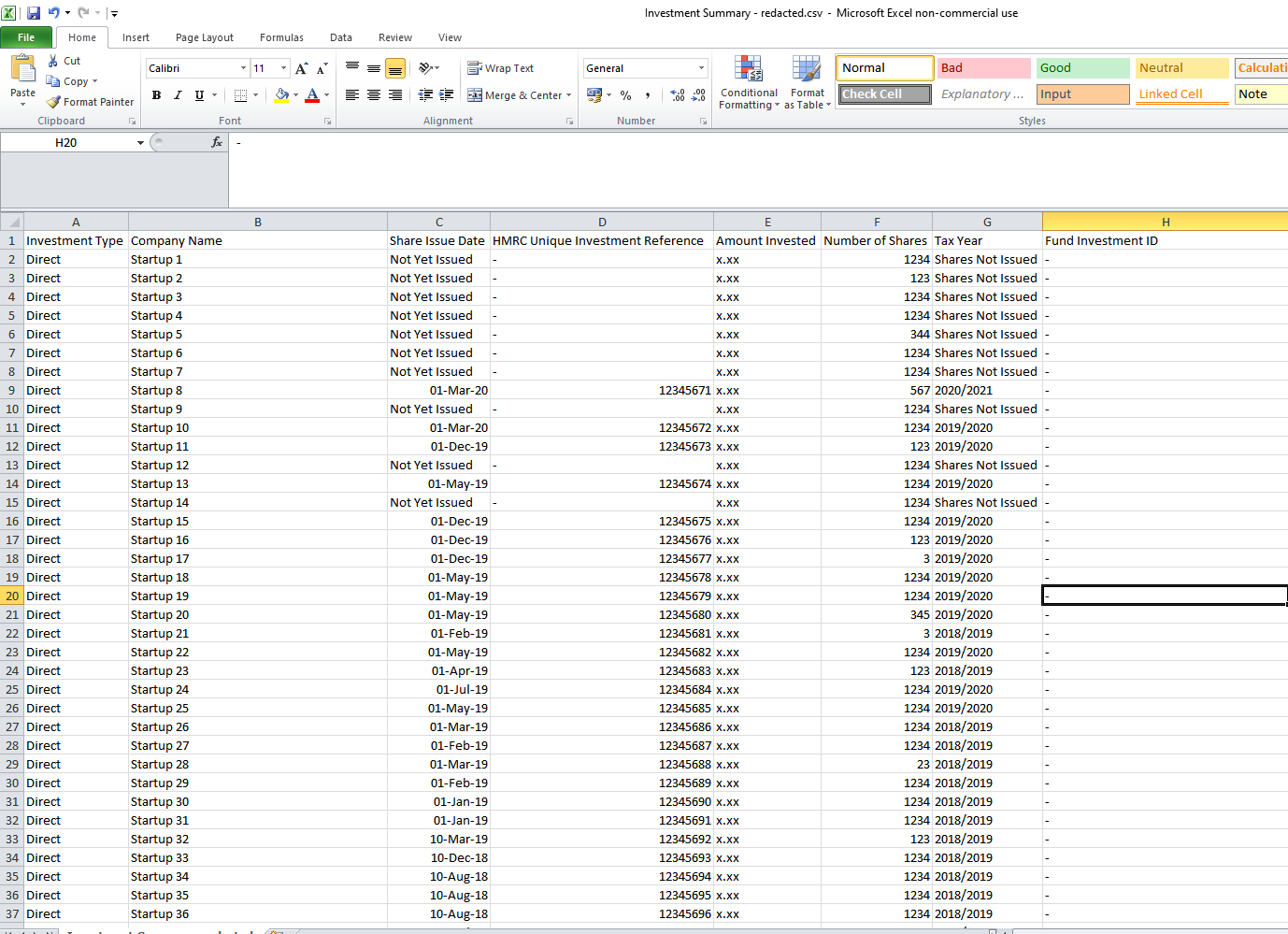

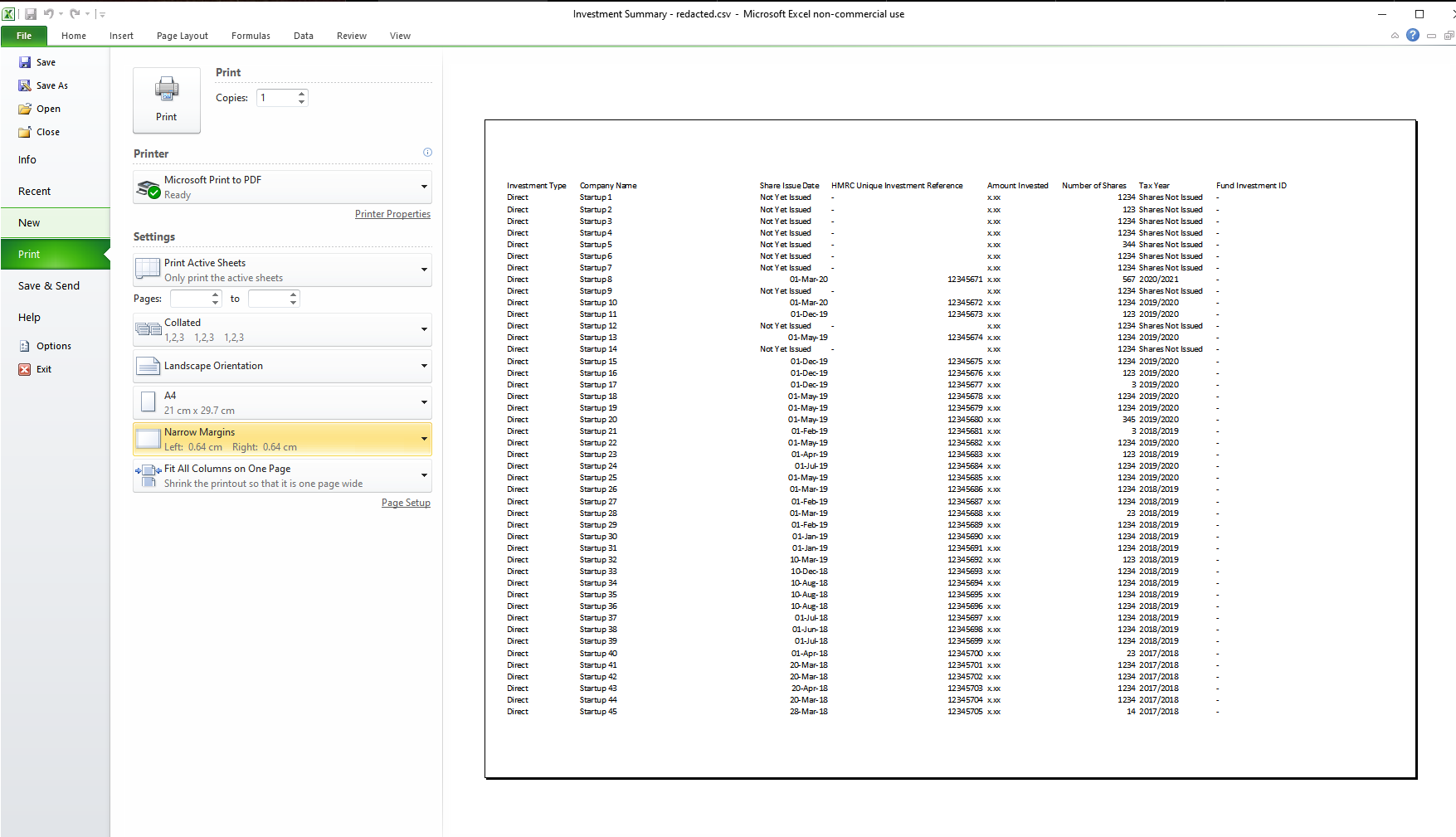

When you open the .csv file, it will look something like this:

Before converting and attaching the file, be sure to remove any companies that do not have a Unique Investment Reference (UIR) as the EIS certificate for those companies will not have been issued yet. You should also remove companies for which you will be applying your relief to a previous tax year. Only include the companies with a UIR for which you are claiming tax relief in the current tax year.

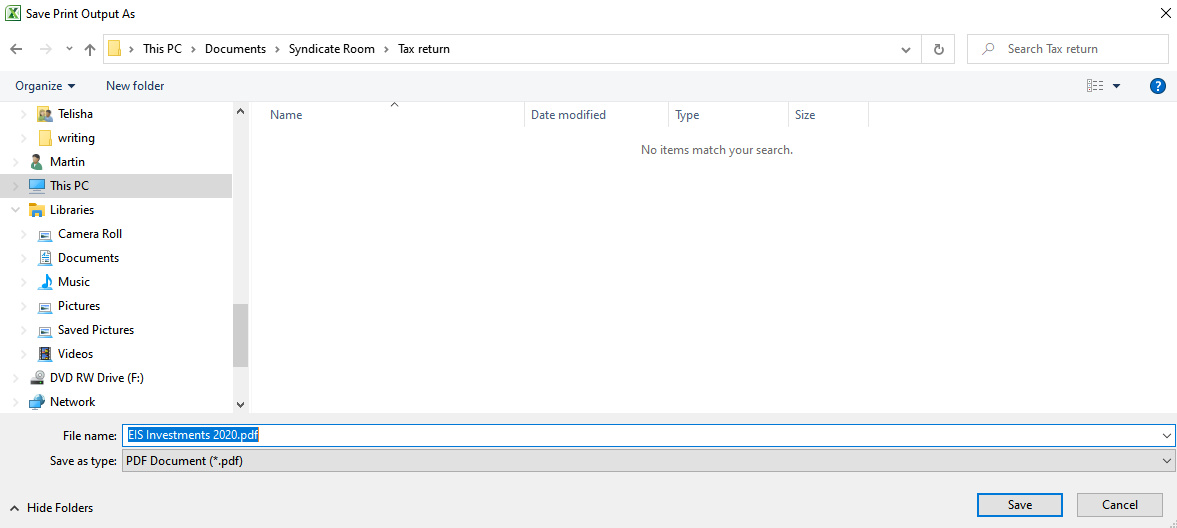

To convert it to PDF, in Microsoft Word or Google Docs, go to File > Print.

Where it says ‘Printer’, select ‘Microsoft Print to PDF’. Below this, select landscape orientation, and in the scaling menu, select ‘Fit all columns on one page’. Then click "Print".

Where you see the option to attach a file to your tax return, select this .pdf file and attach it.

Step 4.

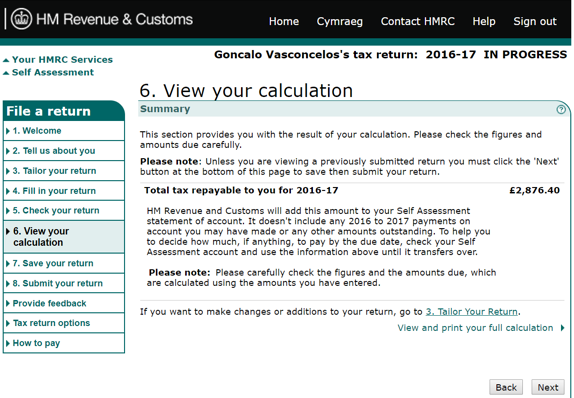

You will be shown the calculation of the tax relief for which you are eligible. Check that this is correct and click "Next" to proceed.

Step 5.

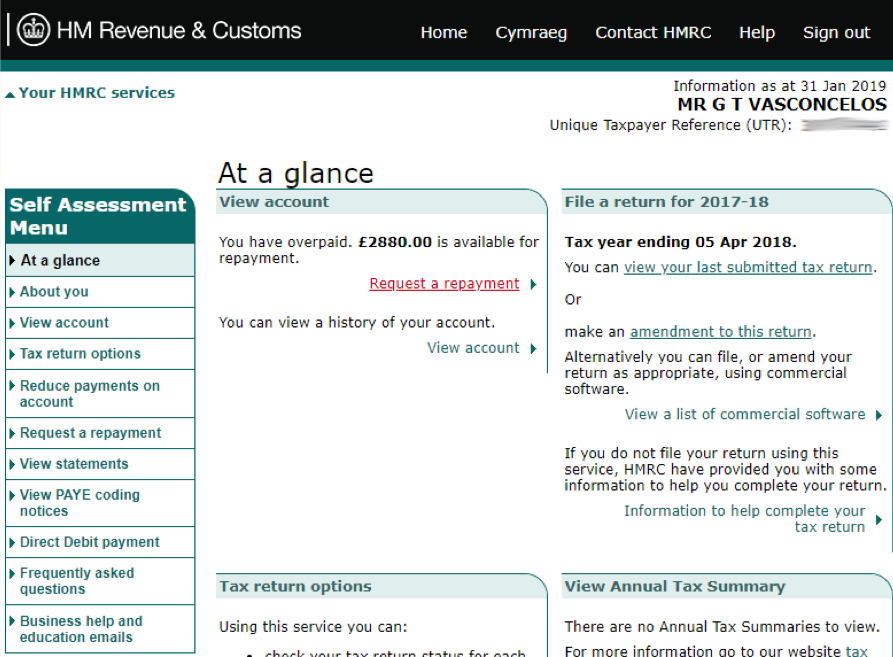

Click "Request Payment"

Step 6.

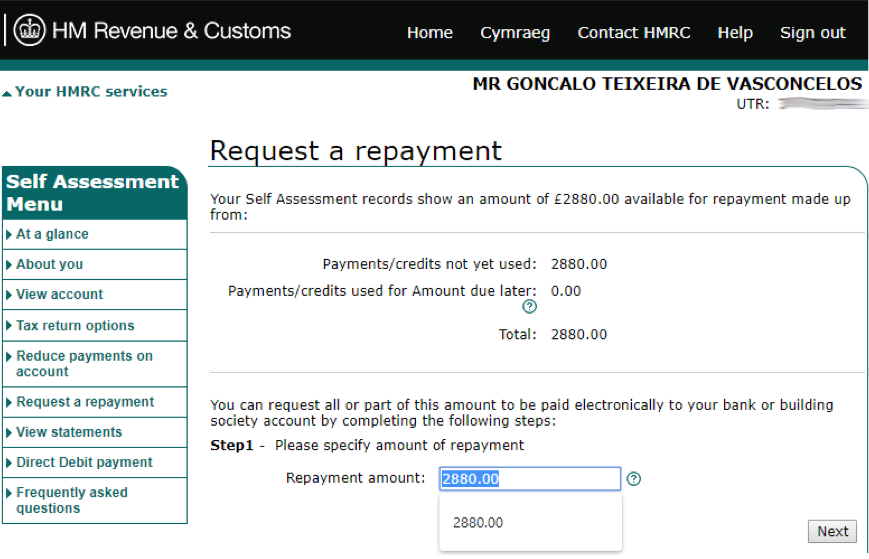

Request a repayment – insert the amount you wish to request for repayment

Step 7.

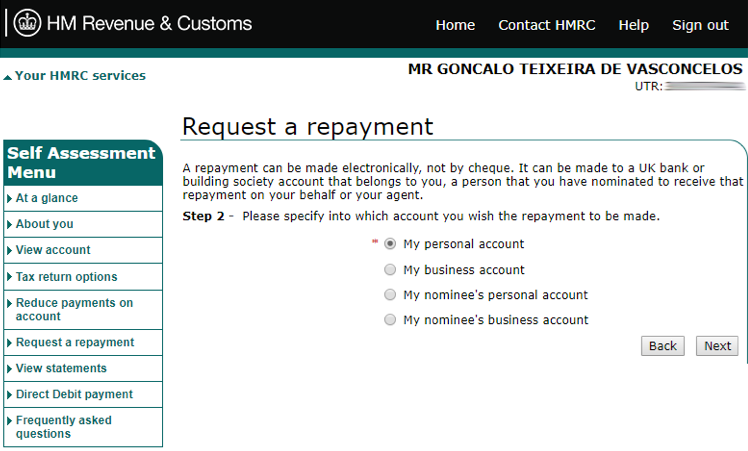

Select "My personal account"

Step 8.

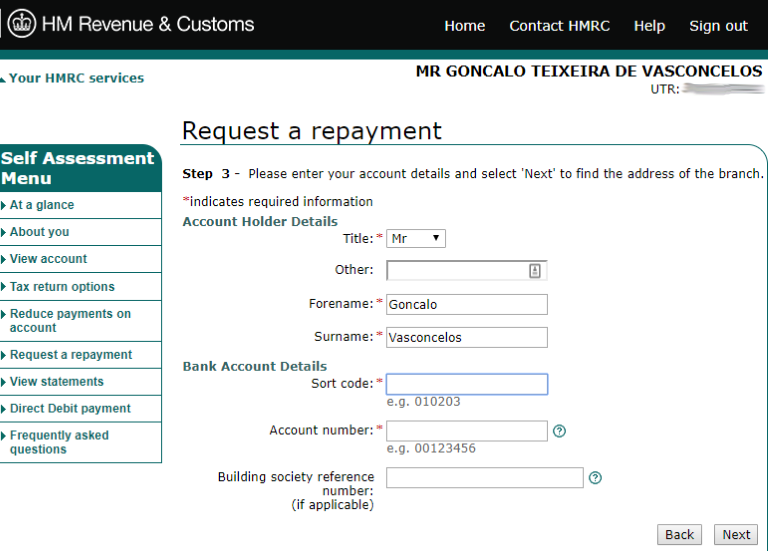

Include your personal details

Once you confirm your details are all correct, you''re good to go! As always, if you have any questions, you should consult your financial adviser.

Our funds

Looking for a hassle-free way to build a diversified portfolio of EIS-eligible startups? We have multiple venture capital funds that offer different strategies to build your diversified portfolio.