Please note: our office hours are weekdays, 9.30am - 5.30pm.

Recruitment agencies, recruitment apps, new approaches to candidate screening and presentation. Why do people choose to invest in recruitment companies? The recruitment industry is something most people are familiar with, either as candidates, employers, or both. In the wake of Brexit, and the pandemic, the recruitment space became supercharged with demand as businesses re-emerged from lockdown with new plans in place, new roles to fill, and a dramatically different working landscape, with increased demand for homeworking opportunities.

In 2021, over 6,000 new recruitment businesses were registered in the UK alone. That might sound like a lot, but it was just a 3% increase on the previous year. In fact, that number of new recruitment business registrations has been growing at 20% year on year over the last decade.

The recruitment and staffing industry contributed £42.9 billion to the UK economy in 2021, a 21.7% increase on 2020 and a rise on pre-pandemic levels. It also made 22.4 million temporary or contract placements and 540,000 permanent placements in 2021, according to the latest Recruitment Industry Status report (RISR, Nov 2022). Overall, the UK''s recruitment industry market value hit £141.2 billion in 2022.

As you might expect, the startups aiming to disrupt the recruitment industry have a lot of competition on their hands, but similarly, a lot of opportunity. While there is never a shortage of people looking for work, matching the right person with the right role is where it gets complicated, time consuming, and expensive. As technology moves on, many startups have emphasised bringing a greater deal of precision to the recruitment space, allowing employers to screen candidates in a way that delivers results, and allowing candidates to give themselves the best possible chances for success.

As Chris Pollard lays out in UKRecruiter, the UK recruitment industry attracts startups because it has favourable regulations, an ease of doing business, and the dynamic between employer, recruiter and candidate is well-defined. That solid foundation creates ideal conditions for "recruitment tech", innovations around software design, search, AI, data transfer and video generation and ever developing opportuities for the integration of recruitment options with social platforms or other SaaS products.

Access EIS Fund investment date: February 2020

Inploi is a recruitment marketing platform built to connect great employers with the future of the workforce. With employer branding at its heart, inploi empowers companies to speak to candidates as consumers of workplaces, helping them to tell their stories with captivating videos, images, and written content to engage active and passive candidates. For jobseekers, inploi provides a beautiful professional presence making it easy to access career-related information, apply for job opportunities, and connect and communicate with employers, and with each other.

Access EIS Fund investment date: April 2021

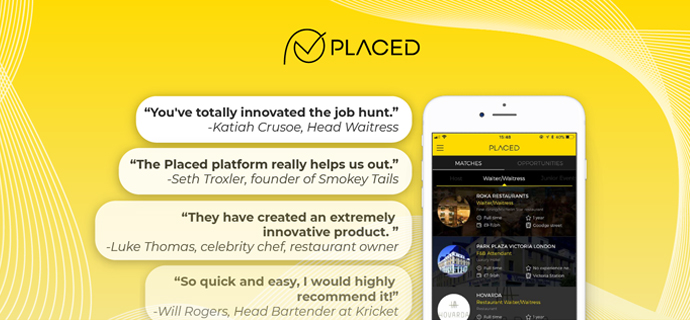

Placed Recruitment was developed to cater to the needs of the next generation of tech savvy, mobile-first candidates and employers, particularly industries with high turnover. Launched in 2016, it developed a more modern, personable job-matching platform that speeds up the recruitment process for employers, which has seen 130,000 candidates sign up, along with thousands of businesses in London.

Read more about Placed Recruitment

Our Access EIS fund builds a diversified startup portfolio for you by co-investing with experienced angel investors. It aims to build a portfolio of at least 50 companies for each investor to further mitigate risk, and to replicate annual market growth in the UK startup sector.

A data-driven approach to venture capital investing that aims to minimise risk.

Access to a larger portion of the startup market through co-investment with experienced business angels.

Generous tax reliefs as part of the EIS scheme for qualifying investors.

Low minimum investment of £5,000.

A fully digital online portfolio dashboard where you can view your investment and the latest share prices of your individual holdings at any time.

With SyndicateRoom you gain access to invest alongside professional investors receiving the same share class and same share price.

{% button /join "JOIN SYNDICATEROOM" primary %}