Equity crowdfunding offers investors the chance to back new private companies by buying their shares online and thereby funding them. These shares are illiquid, as there is no marketplace for them until the companies are purchased or go public. So, it is important to do your research before you invest.

Compiled by Rob Murray Brown in conjunction with SyndicateRoom, The Due Diligence Guide for Investors helps you uncover what to look for and what to avoid.

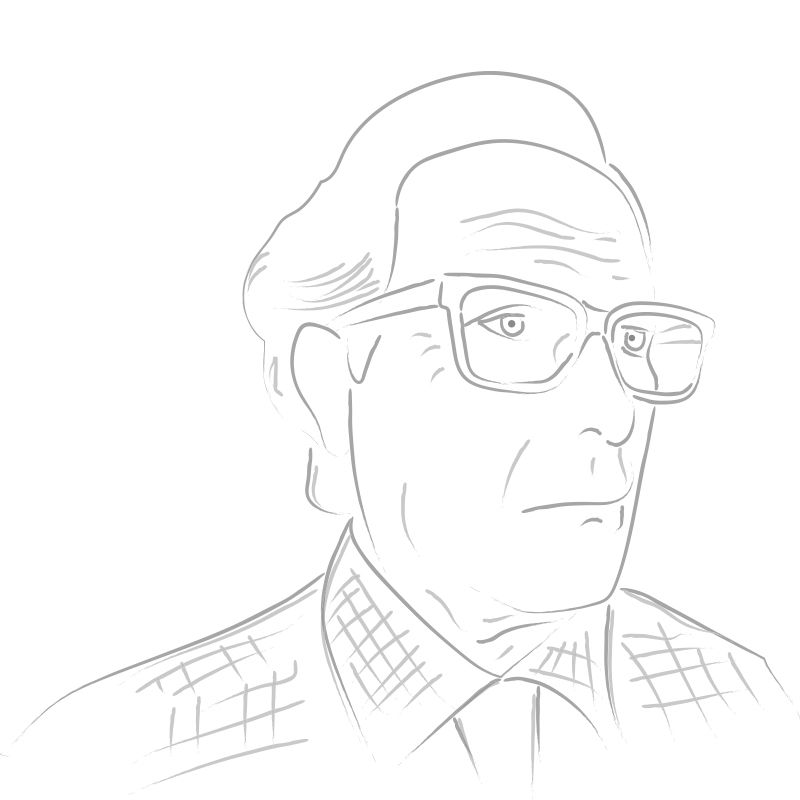

Compiled by Rob Murray Brown

After selling his retail business, he spent a year at Cranfield completing an MBA. Rob’s blog, The Truth About Equity Crowdfunding, is read and quoted by the FCA and over 1,000 readers per week.

His latest project is ECF Solutions Ltd, which advises companies on using equity crowdfunding and consults for select platforms.

Tell us what you think

Back to publications