UK inheritance tax (IHT) is no longer a concern only for the ultra-wealthy. With frozen thresholds and rising asset values, IHT has become a significant "wealth leak" for thousands of UK families, with receipts reaching £8.2 billion in 2024/25: an 11% increase over the previous year.

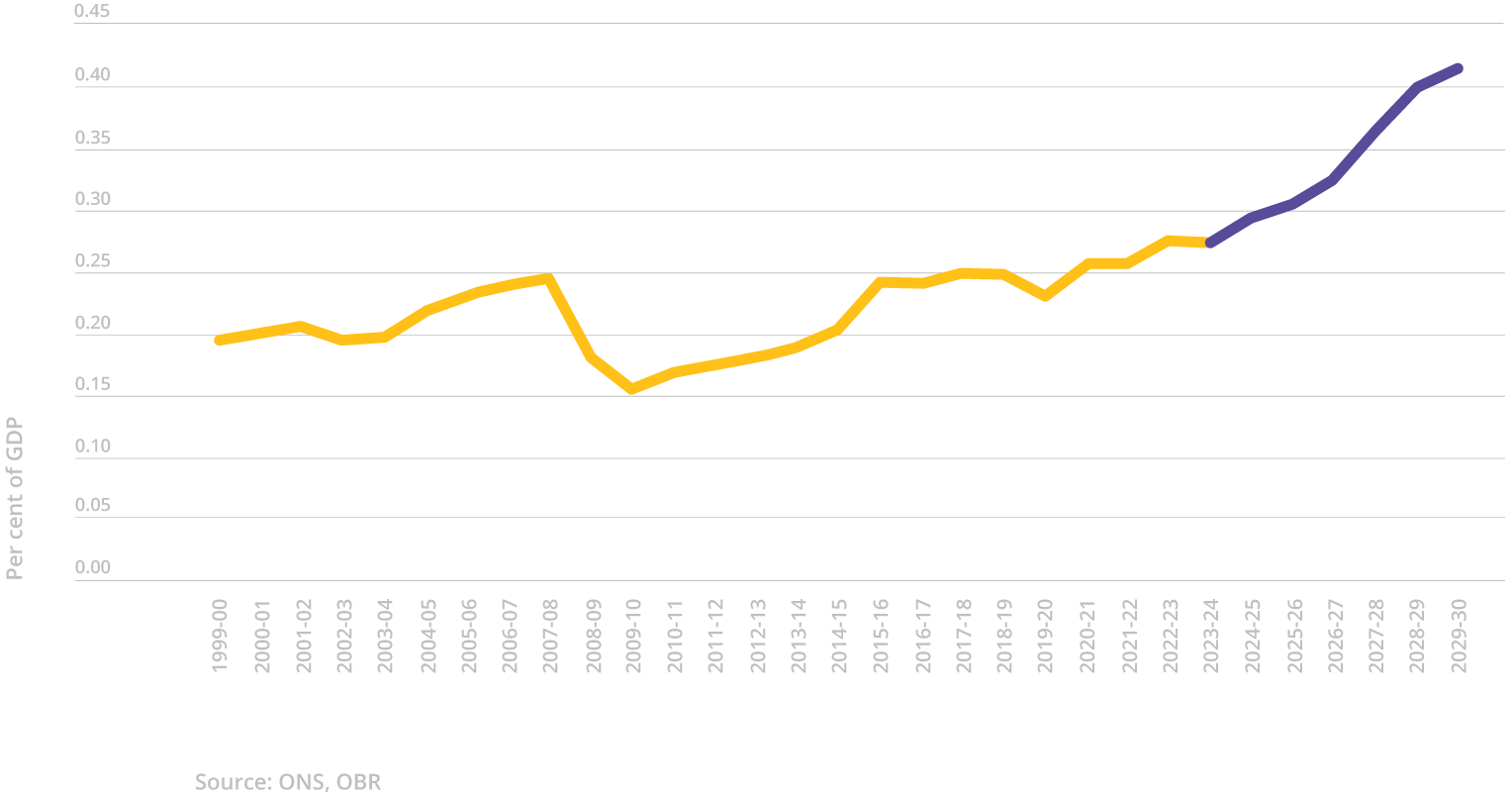

Inheritance tax, latest forecast. Showing IHT as % of GDP over time.

Current OBR forecasts suggest this trajectory will accelerate, with receipts projected to reach £14.3 billion by 2029/30. This is largely driven by a "triple squeeze" on estates: the freezing of the £325,000 nil-rate band until 2030, the inclusion of unspent pensions in the IHT net from April 2027, and new caps on business and agricultural reliefs.

With 4.62% of UK deaths now triggering an IHT charge, proactive planning is a necessity for protecting generational wealth.

Smart investors use the following strategies and insights to help lower their inheritance tax bill:

From 6 April 2026, a significant shift in Business Relief (BR) will occur. While qualifying assets previously received 100% relief regardless of value, a new combined £2.5 million allowance (covering both BR and Agricultural Relief) will apply to individuals.

The strategy: Assets above the £2.5m threshold will only receive 50% relief, resulting in an effective tax rate of 20%.

The rebalancing act: Critically, 100% relief for AIM-listed shares will fall to 50% across the board starting April 2026, regardless of the allowance. Investors should review unlisted EIS and SEIS portfolios, which remain eligible for the full 100% relief within the new allowance, as a primary vehicle for rebalancing.

For more details on these mechanics, see our HMRC Business Relief guidance.

For estates significantly above £1 million, a Family Investment Company (FIC) can offer a more flexible alternative to traditional trusts.

Control & succession: parents can act as directors to retain control over assets while gifting different classes of shares to children to transfer future growth outside of their taxable estate.

IHT efficiency: by using growth shares, founders can freeze the current value of their estate while ensuring all future appreciation belongs to the next generation, avoiding the 40% IHT hit on that growth.

Tax arbitrage: FICs pay corporation tax on income and gains, which is often lower than personal higher-rate income tax or dividend tax rates.

Traditional gifting remains a cornerstone of estate planning, but it carries significant risk, given its dependency on survival. While the first £3,000 gifted annually is immediately exempt, larger Potentially Exempt Transfers (PETs) require you to survive for seven years.

Years between gift and death | Effective tax rate on a gift |

0 – 3 years | 40% |

3 – 4 years | 32% |

4 – 5 years | 24% |

5 – 6 years | 16% |

6 – 7 years | 8% |

7+ years | 0% |

Taper relief: if death occurs between three and seven years after a gift, the IHT due is applied on a reducing scale.

The smart alternative: While gifting takes seven years to be fully effective, investments in qualifying SEIS or EIS funds qualify for Business Relief and fall outside your estate in just two years.

For estates with illiquid assets (like property or private businesses), Whole of Life (WOL) insurance is an essential tool to prevent the forced sale of assets to pay an IHT bill.

Guaranteed payout: unlike term insurance, WOL policies are guaranteed to pay out upon death, providing a lump sum specifically to cover the IHT liability.

Outside the estate: It is vital to write these policies into a trust. This ensures the payout goes directly to beneficiaries to pay HMRC, rather than adding to the value of the estate and incurring further tax.

High-intent investors use the elief stack provided by EIS and SEIS to maximise capital efficiency while mitigating IHT. Tax treatment depends on individual circumstances and may be subject to change.

The Enterprise Investment Scheme (EIS) allows for larger allocations, making it ideal for rapid IHT mitigation.

Investment limits: claim relief on up to £1 million per tax year (or £2 million for Knowledge-Intensive Companies).

IHT status: assets are 100% exempt from IHT after a two-year holding period.

The relief stack: benefit from 30% upfront income tax relief, tax-free growth, and capital gains tax (CGT) deferral.

Action: learn more about building a diversified IHT-efficient portfolio via the Access EIS Fund.

The Seed Enterprise Investment Scheme (SEIS) offers the most generous tax breaks in the UK to reflect the earlier stage of the companies.

Relief rate: benefit from a massive 50% upfront income tax relief on investments up to £200,000 per year.

CGT exemption: SEIS is unique in offering 50% CGT reinvestment relief, meaning you can eliminate half of an existing capital gains tax bill.

Succession planning: like EIS, these shares are 100% IHT-free after just two years.

Action: explore the climate-focused opportunities in our latest seed-stage fund, Carbon13 SEIS.

In the world of IHT mitigation via high-growth investments, the asset itself must be resilient. It is not enough to simply qualify for relief; the investment must protect the underlying capital.

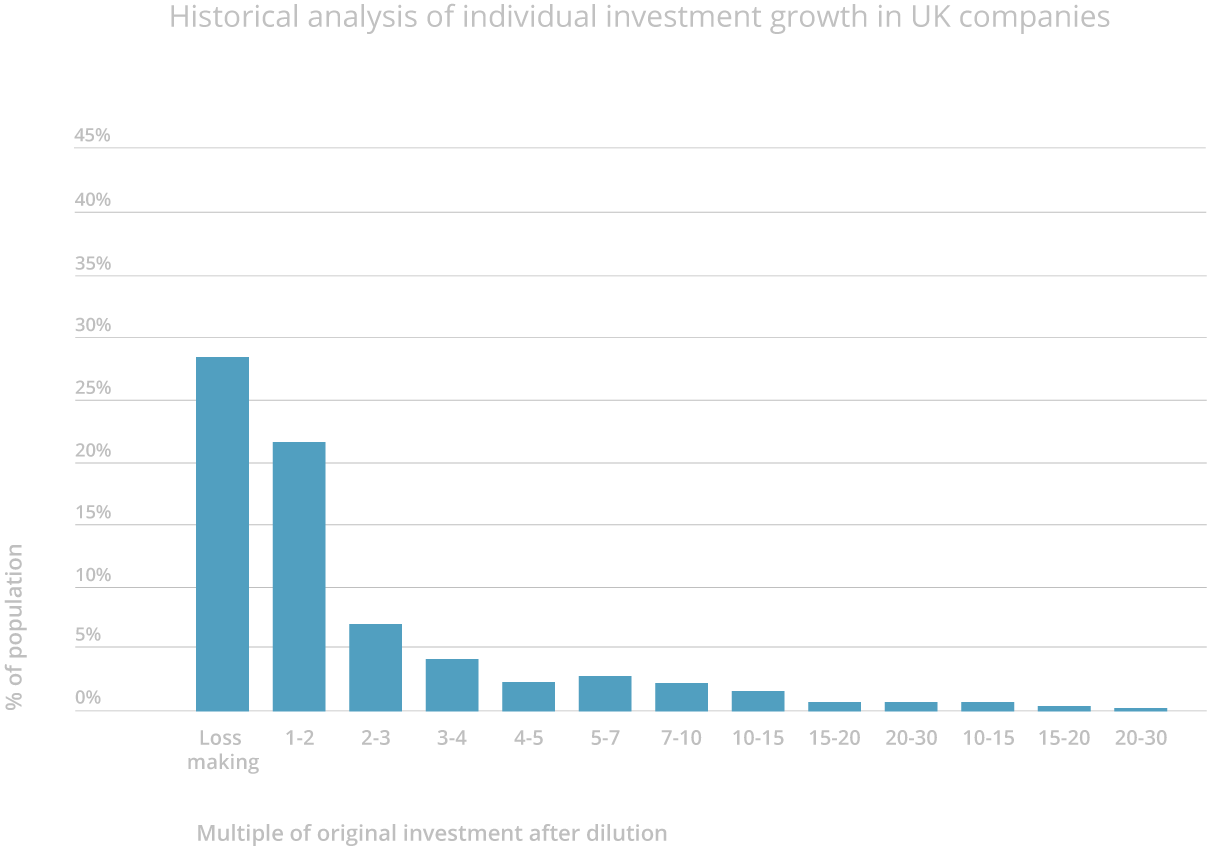

Our data on 1,000+ startups indicates that 90% of un-diversified portfolios fail to return capital. Sophisticated investors utilise a mathematical necessity of diversification strategy to ensure their IHT shield is backed by probability, not guesswork.

The window for optimal planning ahead of the April 2026 reforms and April 2027 pension changes is narrowing.

Model your savings: use our IHT relief calculator to see the impact on your specific estate.

Stay informed: review the OBR latest forecast to understand the long-term trajectory of UK tax policy.

Please note: our office hours are weekdays, 9.30am - 5.30pm.