We recently talked about four important sectors that our network of angel investors expressed a particular interest in for the coming year. In this piece we'll focus on one of these sectors: technology. We'll also be speaking to one of our portfolio companies to get the founder perspective on this sector in an upcoming podcast, so stay tuned for that.

Many venture capital investors have a preferred sector or sectors that they are particularly drawn to. In many cases, it's based around the investors' own expertise and experience, or particular characteristics of that sector, such as speed of growth, ability to scale, size of market and so on.

While every sector has its advantages and disadvantages, some are particularly sought after for their broad appeal, adaptability and the likelihood of generating returns quickly, along with their implications with regard to positive impact upon social and environmental conditions.

Our fund - Access EIS - is sector agnostic, but for each sector we invest in, we partner with an experienced angel investor who can demonstrate a track record of investing in that sector, because knowing the ins and outs of any given sector is a huge advantage when it comes to understanding which companies are more or less likely to succeed.

Technology

The technology sector is without a doubt one of the broadest, most exciting and most important sectors in the UK's startup ecosystem. Of course, it is ubiquitous, overlapping with almost every other sector from education to hospitality, recruitment, life sciences, green, finance, legal and the rest, with innovations across software platforms and generative artificial intelligence in particular presenting ever new, more cost effective, and user-friendly ways to solve age-old problems.

(Source)

For clarity's sake: in this article we are defining 'technology' both as businesses which introduce a technological solution via software, hardware, artificial intelligence and so on to another sector, like clean energy generation, or life sciences, as well as those whose product is purely tech: software, hardware and so on.

Vitally, the integration of new technologies with existing systems is inexorable, and while fluctuations in markets and the economy may mean the success or failure of individual businesses, as a general trend, the march of technology, innovation and investment is not going to stop any time soon:

"The economic situation may look dire, but it doesn't impact the macro trends that are driving the best business ideas. Digital transformation is still progressing rapidly, with many legacy businesses being transformed by the capabilities of technology. In most cases, this is the only way to achieve the efficiency gains needed to meet societal and client demands, and it won't grind to a halt just because market sentiment has shifted." Kjartan Rist, Contributor, Forbes, Oct 27, 2022.

One crucial idiosyncrasy with technology businesses – that in many cases, the problems they solve are not new – means that innovative solutions find an existing marketplace and present unparalleled opportunities to scale rapidly. People have been taking taxis for years. Then in 2009, Uber was founded. It now operates in 10,500 cities worldwide, in 70 countries, and has 131 million monthly active users as of 2024, with annual revenue in the tens of billions, thanks to the convenience and accessibility of its digital interface (Uber insists it is a technology company, though to most it is a transportation company. Regardless, its product brings the two together).

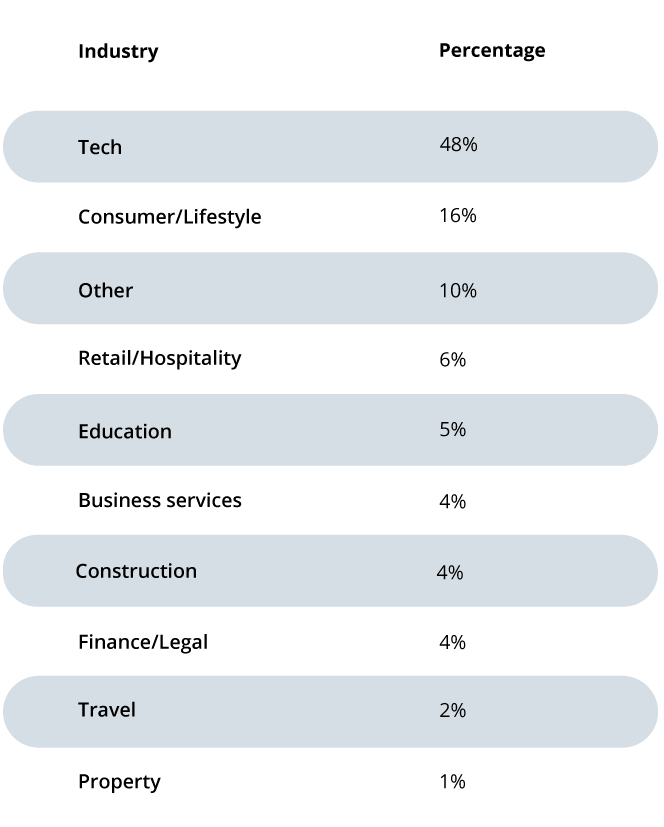

In 2023, Startups 100 found the following:

"According to our findings, the tech industry is still the most popular sector for new UK businesses. Rapid digital transformation continues to accelerate sector innovation, and our results show it remains a safe industry for UK startups, with a new business population growth of 7% year-on-year." - Source

It is possible then to see the technology industry generally, and investment in new technology businesses specifically, as participation in a process that's going to happen regardless of market conditions. The question for investors is which specific businesses, which specific areas of the broad technology landscape, and when to get started?

Timing

While the tech industry has always been popular, its popularity surged to unprecedented levels between 2021 and 2023 largely due to emerging technologies such as generative artificial intelligence, blockchain, and machine learning. In 2022 alone, £21.2b worth of announced equity deals were raised by UK startups in the technology industry, compared to £11.4b in 2020 – a massive 86% surge in investment. (Source, Beauhurst)

These innovations have had a dramatic impact on the potential of the technology industry, making new solutions and applications possible. You can read more on some of the applications of artificial intelligence employed by Access EIS portfolio companies in this article.

Despite challenging economic conditions making life harder for startups (although it is possible to overstate this: don't forget, 2024 ended on a strong note with record highs in stock markets and a gradual easing of interest rates and market volatility.), this is a particularly compelling time for investors to start building their technology portfolios and buying stakes in some truly groundbreaking, disruptive technologies.

Technology and the UK

The UK is Europe's leading tech ecosystem, with a strong emphasis on SaaS (software-as-a-service) businesses (3,284), closely followed by artificial intelligence (1,506) and fintech (1,338).

Technology companies represent a large proportion of the 64 unicorns founded in the UK (as of December 2023, source), with companies like Revolut, Monzo, Wise, and Deliveroo leading the way, and their current or former employees founding more than 100 startups of their own.

According to a 2022 government press release, the UK tech sector employs more than 3 million people, and raised more than France (£11.8 billion) and Germany (£9.1 billion) combined in 2022 (£24 billion). The release attributed the UK's success over European peers to a higher level of venture capital investment, and a forward-thinking approach to regulation encouraging digital innovation and competition. In 2022 it also unveiled a new approach to regulating AI – "based on core principles like safety, transparency and fairness – to take a less centralised approach than the EU to reflect how AI is used in their sectors."

While the main focus of technology investment in the UK is fintech, it is also becoming a leader in impact tech - companies creating technological solutions to reach the UN Sustainable Development Goals. There are nearly 1,200 impact tech companies in the UK which raised £3.12 billion in funding in 2022, exceeding 2021's record £3 billion.

What does this mean for UK investors?

Startup investing is a high risk investment. While singling out the tech companies that are likely to go the distance is by no means a precise science, the UKs track record as a breeding ground for tech unicorns certainly helps to incentivise investors to focus their energy, and their funds, on the UK's promising new tech businesses.

An additional factor to consider is the presence of a large and experienced tech workforce in the UK. As mentioned earlier, many employees of the UK's tech unicorns go on to found tech startups of their own, fostering a virtuous cycle of expertise and innovation in this sector.

On top of a flourishing domestic tech sector, the UK has a selection of investment vehicles that incentivise investment in startups with a range of tax reliefs. Investment schemes like SEIS, EIS and VCT aim to offset what is undoubtedly a high risk investment – early-stage startups fail, more often than not – with significant reliefs across income tax, capital gains tax and inheritance tax, as well as allowing investors to offset the value of companies that fall below their effective cost against their tax bill.

You can read more about the benefits of these tax-efficient venture capital investment schemes in this article.

To find out more about how the Access EIS Fund can work for you or your clients. Use the button below to schedule a call with our expert, Tom Britton.

Technology companies in the Access EIS portfolio

Slip is an award-winning startup on a mission to create a global standard for digital receipts.

Its innovative technology provides a robust solution for consumers and retailers to transform transactions and receipt waste into meaningful interactions. Its mission is to create the most frictionless, sustainable and omnichannel experience available.

Slip's share price has increased by 114% since our investment in 2022

Themis provides an end-to-end ecosystem to help businesses identify and manage their specific financial crime risks. These risks include money laundering, sanctions, bribery and corruption, fraud, and many others. Launched in 2019, its secured large clients including Dow Jones and TSB.

Themis' share price has increased by 206% since our investment in 2020

Pillar is an intelligent cycling coach, built to empower all cyclists to hit their goals, on their terms. Get fitter than you ever have before and avoid getting ill and injured from overtraining. Understand where youʼre at, what youʼre capable of, and what you need to do to get to where you want to be.

Pillar's share price has increased by 113% since our investment in 2020

Manage your capital gains with EIS.

The Enterprise Investment Scheme offers investors significant tax reliefs which range from income tax relief to capital gains tax (CGT) deferral and disposal relief. If you want to get up to speed on EIS CGT deferral rules, the CGT deferral relief time limit and more, download our free guide to how the capital gains tax reliefs work, how to claim them and how to get started as an EIS investor.

Please note: our office hours are weekdays, 9.30am - 5.30pm.