The Access EIS Fund is unusual among VC funds. Where many funds rely on a fund manager to make EIS investment decisions, Access EIS employs a co-investment approach. It invests in startups alongside carefully selected angel investors who have demonstrated their ability to build profitable portfolios and have well-developed networks, giving them access to some of the most promising new startups around. Then it builds investors large portfolios of 50 companies in order to optimise return potential. In 2022, it was the UK’s second most active fund, according to Beauhurst.

Why this approach? Because of the data. The Access EIS model was developed after years spent analysing UK startup market data and running simulations to figure out the ideal fund structure for growth. You can read more about the results of that research and the principles that underpin the model in the fund’s foundational white paper. If you’d like to know more about why portfolio size matters, check out the fund's second white paper.

Just over four years after it was launched, what led to the creation of this different kind of fund, how have the last four years been, and what do the managing team expect of the medium and long term?

How Access EIS began

1. How did you come up with the idea for a different kind of EIS fund?

Graham Schwikkard, CEO: We didn't set out to make a different kind of EIS fund really. We just knew that (A) we had a lot of data and could run a bunch of calculations and investment simulations to figure out the right portfolio construction strategy and (B) wanted to make sure it could access good deal flow and be attractive to that deal flow. The access element, getting into the high potential deals, was something our previous model was not good at.

The first part involved a lot of data analysis and that's how we figured out larger portfolios performed better, but also determined ticket size, round size and valuation targets. The second part was based on a lot of interviews we did with founders, and then we simply brought in the data to help us identify the angel investors who had the best deal flow. From then it was a lot of workshops to iron out how exactly we would implement the ideal structure and model. It wasn't easy.

Fran O’Brien, Partner: Our research demonstrated that the effects of diversification really do increase with volume, and with 50 companies in every investment, that’s a really meaningful level of diversification.

We also wanted to make the fund a truly excellent experience for entrepreneurs, to attract the best. Good companies tend to receive offers for investment rather than having to go hunting for it, so if you make the process of receiving it complex and time consuming you won’t get a look in. By simplifying the process and always converting we could ensure that our EIS fund would be of genuine interest to high traction startups.

Tom Britton, Founding Partner: I found myself listening to people, including Graham and Fran, talking about the way things were currently being done and how it was suboptimal. They were right, and when we spoke to investors, companies and advisers we knew we had to do something different to try and bring structure, resilience, consistency, and most importantly a process free of obstructions and delays into how people invested.

2. How were the early days of the fund, what went well, what was a challenge?

Graham: Tough because we had no blueprint. No one else runs a fund like this. We had to figure out each part of the value chain and operations. As an example, we wanted the fund to be truly evergreen (not just rolling closes). The only way to do this is for an algorithm to pull all the active investments (i.e. investments which still have funds to deploy) into an active pool and derive an investment amount for each new investment. Then you have to think about, ok well how do we communicate this with potential companies? How long do we commit to their round for until we need to add new activated investments? How do you show each individual investor what companies they have invested in? How do you complete daily client money reconciliations? It's a lot to figure out but luckily we have a great team and in house dev team to build what we needed.

Fran: Building a network to supply both companies and investors to a fund is always the biggest challenge a fund will face. We’ve been lucky to capture people’s attention with the unique approach that Access takes, but we’re always wanting to make sure that the best companies know about us, and that more investors can diversify their portfolios through us too.

Tom: The principles of the fund were sound and the data was clear, but the industry was and still is quite set in its ways, even though things are often done inefficiently, certainly from the investors’ perspective. Something so radically different, despite the analysis conducted, seemed a bit scary to them at first. They could read our reports and still question if it could be done, particularly building such diversified portfolios. Convincing those first early adopters took time but once we showed them we could actually deliver it started to become easier.

3. If you could tell yourself at that time something you know today, what would it be?

Graham: Charge more! It's easy to set a low price because you are efficient and you want to show it can be done at low cost, but that doesn't mean the value you are bringing shouldn't be reflected in the price. We later increased the pricing but I think we probably should've gone further. I probably also would've changed the name - there are too many Access fund products and it makes it harder to own the name when it's generic.

Fran: It was worth prioritising research first and not shortcutting to building the same sort of fund that already exists on the market.

Tom: Stick to the core differentiators of the fund and keep it simple. Early on I think we complicated our messaging a little. We’ve made it much clearer now and get a better response.

4. What were early responses to the fund like?

Graham: Really good, we raised £2.5m (the minimum we needed to start investing) in under three months. Then COVID hit, which brought it’s own set of challenges! Companies loved the model too, we have some very good responses from companies who wished we had done it sooner.

Fran: Positive, which was very encouraging.

Tom: Tentative, and some people are still that way as it is so different to what they are used to.

5. What were some highlights of the early period?

Graham: Completing 50 investments in the first year. There really isn't anyone doing that and we weren't even sure we could pull it off in line with our criteria and need for super angels. But we did and that first cohort is doing very well. Getting these angels to work with us. We had no idea if they would let us co-invest and they are all successful in their own right, but they did and I think the team did amazing work in onboarding them and convincing them of the benefits.

Fran: Immediate interest from super angels and those ‘in the know’ in the industry.

Tom: Getting the first million into the fund, making the first investment, seeing the first returns. Those were all great moments. Probably the best though was making it through the pandemic and coming out the other side in a better position than when it started.

How it’s going

6. Comparing the fund today to how it was at the point of conception, what’s different, and what’s stayed the same?

Graham: From my point of view the analysis models have changed a fair bit. I think we're more accurate and detailed and produce a lot more metrics on an individual angel’s portfolio. That's been very helpful in identifying the right ones to work with and which deals to go into. There's a lot that has stayed the same, primarily around the strategy of the fund - large portfolios built around investors with access to the best deal flow.

Fran: It’s remarkably like the fund we’d envisioned, and I do think that’s because we took the time to do the research first.

Tom: Getting the first million into the fund, making the first investment, seeing the first returns. Those were all great moments. Probably the best though was making it through the pandemic and coming out the other side in a better position than when it started.

7. Summarise the fund today in one sentence.

Graham: Diversified startup investing alongside the UKs top performing angel investors

Fran: An easy way to grow a sufficiently broad portfolio of startup investments, always investing alongside seasoned business angels.

Tom: The best way to diversify a portfolio into EIS.

8. What are some of the recent developments in the product that you’re proud of

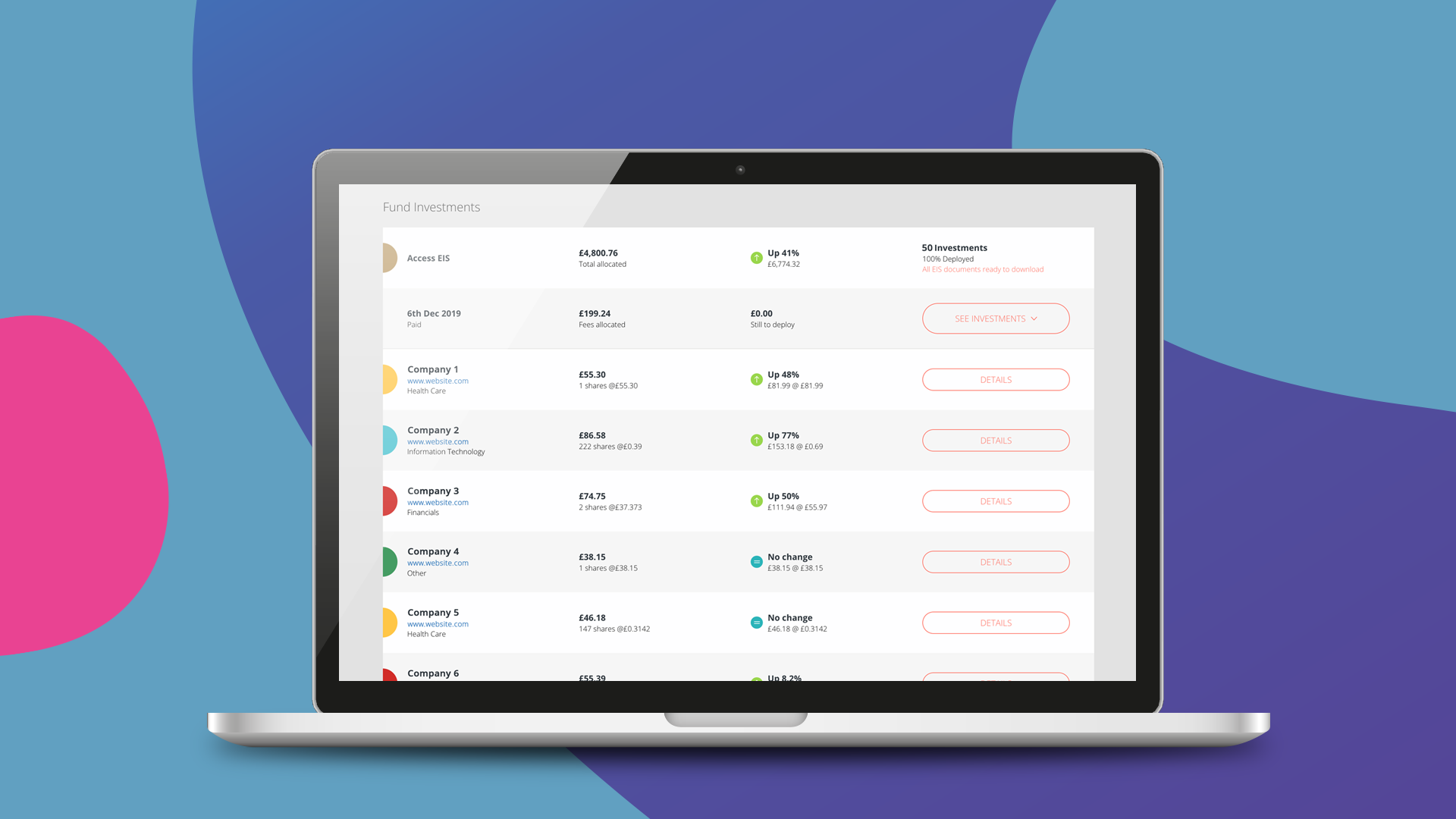

Graham: We've done a lot of work on the investor dashboard to allow each investor to see their whole portfolio position and the latest updates from the company, including a way to download a spreadsheet summarising their portfolio for tax submissions.

Fran: British Business Investments' (BBI) investment and early valuation growth indications.

Tom: Getting accepted onto Independent Financial Adviser (IFA) panels. It’s been a long slog to build up the fund, get the right traction and track record, no corners could be cut, so now that we have IFAs adding us to their panel it’s an achievement to be proud of.

What’s on the horizon?

9. What’s the focus currently around the Access EIS Fund, and the next major milestone?

Graham: It's going to be tough to fit in but we have a lot of companies doing great things and going onto bigger rounds. We need a new fund to invest in those winners. It would have a different risk-reward profile to Access EIS and be a more mature option for investors to take part in.

Fran: Reach a new group of startup investors, and invest in a future unicorn.

Tom: Doubling the fund size and then looking at what a next fund might look like for later stages of investment.

### The Access EIS Fund

Our fund co-invests with proven angel investors to build large portfolios of hand-picked companies for our investors. It’s a high risk investment, and we can’t guarantee that every startup will be a unicorn, but we’re confident that our approach is the smartest on the market. Even better, we can show you the data to prove it.

If you’re interested and would like to find out the benefits of investing towards the start of the tax year, you can call us on 01223 478 558 and we'll be happy to answer any questions you might have.

Or, if you're ready to get started, click the button below:

Please note: our office hours are weekdays, 9.30am - 5.30pm.