Want to join our latest investment opportunities?

Discover startups that we recently backed. We’ve checked the details of each description at time of writing, though these may change. Please enjoy as general information only.

Our fund is open for investment. For more information see here or if you have questions then please get in touch.

- 31-Jan-24

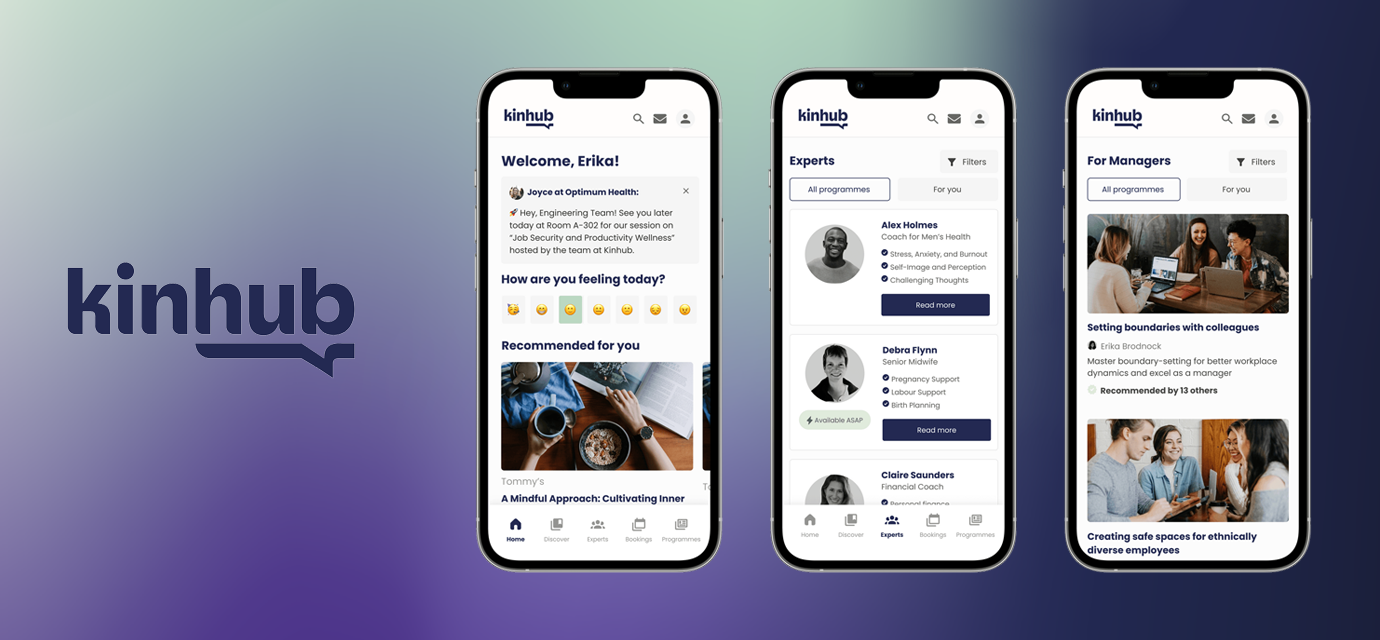

Access EIS invested in Kinhub Kinhub is a health and wellbeing platform that provides employees and managers with personalised support. It provides curated content and 1:1 sessions with industry-leading experts on topics related to health and wellbeing.

- 19-Jan-24

Access EIS invested in At Last At Last champions a better returns experience for both shoppers and retailers, bringing together decades of experience across scaling consumer products, working with top 100 retailers and building financial infrastructure.

- 22-Dec-23

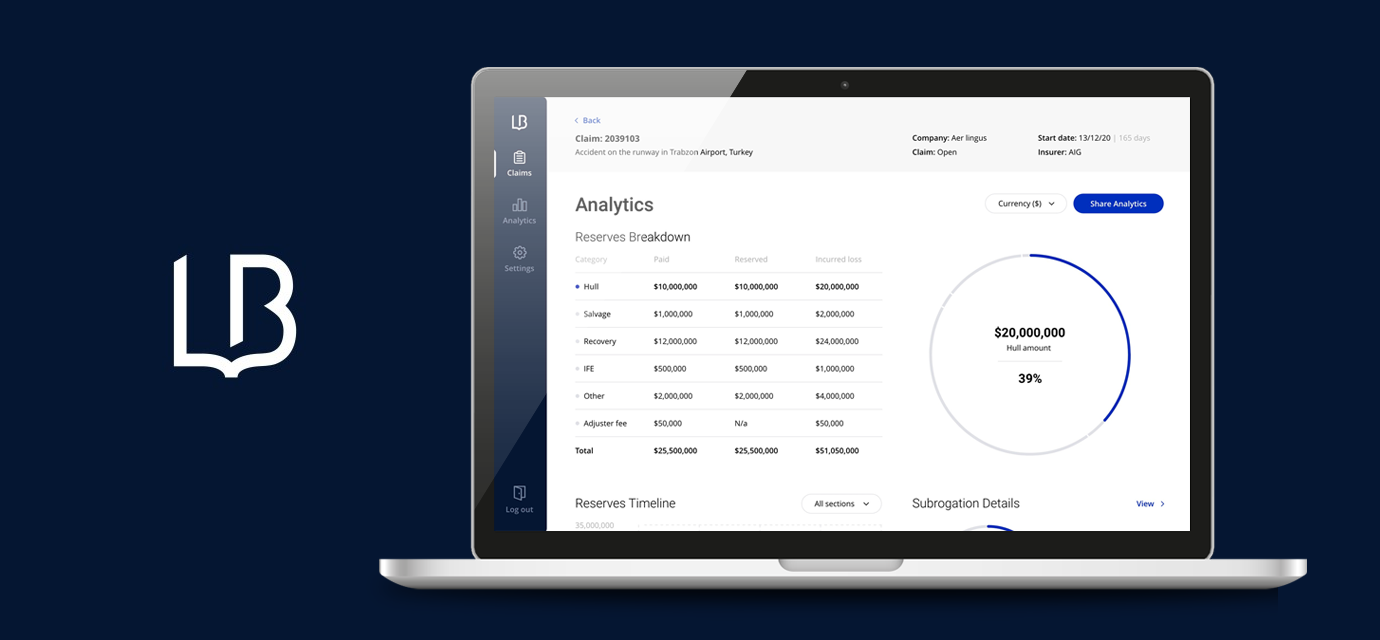

Access EIS invested in Asterias Asterias (formerly Lossbook) is an integrated platform for insured and uninsured losses. It aims to systematise and digitise all loss data at source, and enables seamless collaboration for policyholders, brokers, insurers, adjusters and lawyers.

- 11-Dec-23

Access EIS invested in Different Dog Different Dog cooks different meals for dogs every week and delivers them to customers, with a focus on using ingredients aimed at maintaining canine health.

- 17-Nov-23

Access EIS invested in Grounded Grounded makes protein rich, dairy free milkshakes using only real, natural ingredients "from the ground". It emphasises sustainability and its packaging is 100% recylable.

- 9-Nov-23

Access EIS invested in Recomme Recomme is the first 360° white-labelled circularity system for end-of-life product management – from resale to recycling, it helps businesses access the resale and recycle circular economy.

- 6-Nov-23

Access EIS invested in Noggin HQ Noggin HQ is on a mission to modernise traditional credit assessments, and increase lending to underserved segments. Traditional credit reference agencies rely on data that many people, especially younger people, don't have, so Noggin has designed a credit score specifically for Gen Z and millenials that makes use of data they do have.

- 31-Oct-23

Access EIS invested in Stackt Stackt is a moving and storage tech company that aims to simplify and modernise a very traditional industry. It offers a platform to connect movers and consumers in addition to a storage solution, along with a 360 degree moving service to make moving as simple and effortless as possible.

- 25-Oct-23

Access EIS invested in Asan Asan – which means 'worry free' in Persian, Hindi and Urdu – is a social venture with a mission to eradicate period poverty across the world with a reusable, high quality menstrual cup. For each cup purchased, it donates one and provides menstrual health education to women and girls in India.

- 04-Oct-23

Access EIS invested in Finexos Finexos combines advanced AI, behavioural analytics and real-time data to reduce risk, costs and default rates for lenders, borrowers and society.

- 29-Sept-23

Access EIS invested in Freja Freja is a husband and wife team that produces 100% natural Norwegian bone broth from pasture-fed cows and free-range chickens that are antibiotic, hormone and GMO free. This is the ultimate cupboard-friendly, responsibly sourced and nutrition-packed fast food.

- 21-Sept-23

Access EIS invested in Bowimi Bowimi's software helps the best challenger F&B brands capture and manage their field sales data faster and more effectively than ever before.

- 21-Sept-23

Access EIS invested in Unfabled Unfabled is a consumer health platform transforming women’s wellbeing by providing curated & personalised solutions. They emphasise empowering their consumers and sustainable products free of bleach, chemicals or other toxins.

- 14-Sept-23

Access EIS invested in Ctrl Alt Ctrl Alt works to make investing in alternative asset classes simple, secure and accessible. Since launching in 2022, Ctrl Alt has already achieved success tokenising the first property in the UK, bringing to life its mission to enable fractional investing in previously out of reach alternative assets.

- 12-Sept-23

Access EIS invested in Roomix Roomix is an all-in-one DIY platform bringing together creator content, brands and design services to turn your inspiration into reality in your home.

- 30-August-23

Access EIS invested in Pencil Biosciences Pencil Biosciences is developing an innovative gene editing technology that can have an impact across a range of applications, including new therapeutic options for patients with rare diseases.

- 11-July-23

Access EIS invested in IsosConnect Isosconnect have created a platform that optimises fundamental clinical processes, caters for safe online consultations and offers the opportunity for peer-to-peer work between modalities and specialties to create a digital home for independent health and wellbeing practitioners.

- 20-June-23

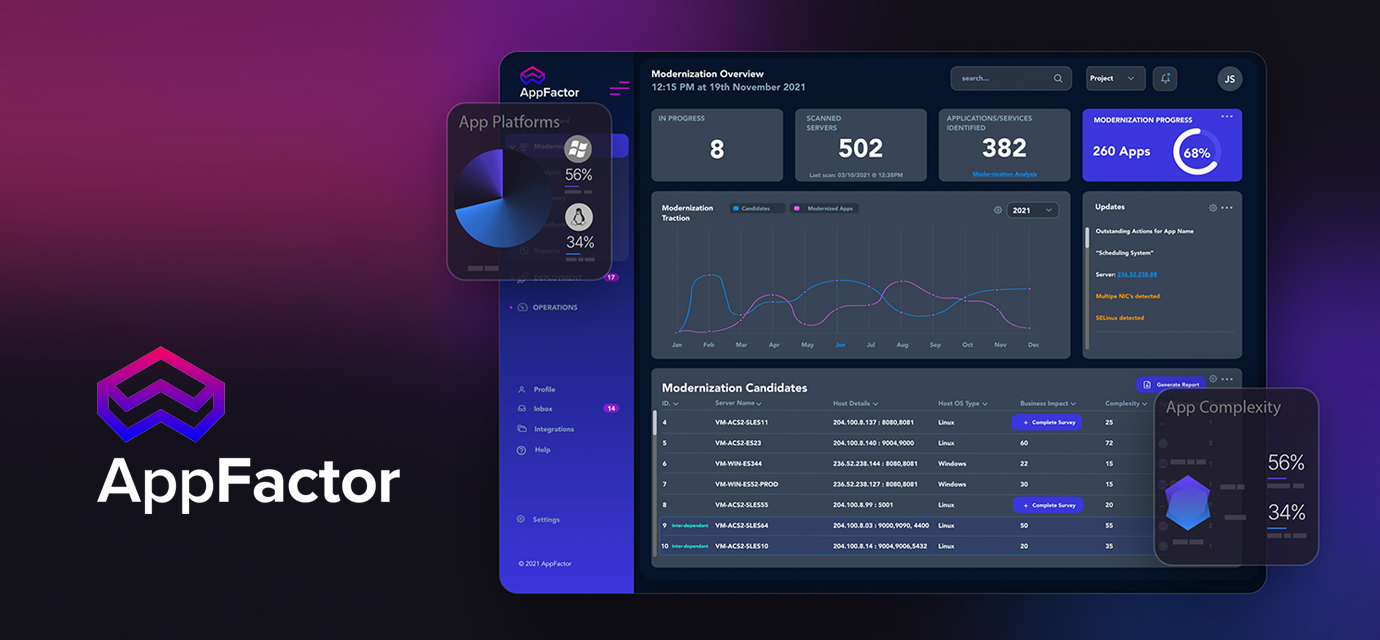

Access EIS invested in AppFactor AppFactor is designed to eliminate the time, risk and cost constraints of manually modernising business applications, delivering a scalable, repeatable factory model purpose-built for cloud native modernisation. It allows users to accelerate the journey to cloud-native architecture and modernised DevOps.

- 20-June-23

Access EIS invested in Thymia Thymia's ethical AI models analyse voice, movement and behaviour to provide clinical grade insights into mental health and wellbeing. At the pre-clinical level it works with providers of mental wellbeing to measure indicators of burnout and other pre-clinical indicators of mental health. At the clinical level it is developing a tool to support clinicians in triaging, diagnosing and more effectively treating mental illness..

- 12-June-23

Access EIS invested in Anansi Anansi has developed a better way for merchants to insure goods in transit that brings a frequently frustrating system up to 21st century standards, with digitised processes and automated, hassle-free claims forming the basis for a range of insurance products.

- 31-May-23

Access EIS invested in Mettle Mettle (formerly Headshed) develops a wellness app for men, providing guidance for meditation, breathwork, and "mind-hacking".

- 11-May-23

Access EIS invested in Renewabl Renewabl is a platform that allows companies to quickly and efficiently meet their decarbonisation targets by matching clean renewable energy certificates directly from real wind and solar farms on a 24/7 basis using blockchain.

- 5-Apr-23

Access EIS invested in Edozo Edozo develops software that allows people in the commercial property industry to store, manage, track and search property deals.

- 28-Mar-23

Access EIS invested in Concr Concr is a mission-driven techbio company that answers essential questions in oncology through solving data. By adopting astrophysics methods used to study the universe, Concr unlocked the ability to effectively integrate diverse and incomplete datasets to help scientists identify and develop molecular features of patient response ('biomarkers') for their drugs with 300x less pre-clinical and 7x less clinical data. Using Concr’s cloud-based platform, FarrSight™, researchers can make advanced predictions about biomarkers, model patient response by leveraging Concr’s unique technology, and perform standard bioinformatics analyses directly.

- 28-Mar-23

Access EIS invested in Osstec Osstec has developed an additive manufacturing bone healing technology, currently applied in partial knee implants. Its implants stimulate long-term bone growth to resolve common sources of failure: loosening and bone loss. Its vision is to keep patients active, pain-free and enjoying added years of improved quality of life.

- 23-Mar-23

Access EIS invested in E-Pharmacy E-Pharmacy works with established brands to bring prescription medication directly to patients, without the need for a medical consultation. In just a few clicks and at a price point close to the £9.35 NHS prescription charge, E-Pharmacy works to ensure patients can access affordable, effective, and safe prescription medication.

- 20-Mar-23

Access EIS invested in Bubbl Built by marketing industry experts and highly skilled developers, Bubbl provides companies with location-triggered mobile marketing tools that build genuine relationships between companies and consumers. They offer accurate and elegant functionality that allows users to deliver sophisticated mobile customer engagement, bridging the communication gap between app, consumer and location, event or venue.

- 20-March-23

Access EIS invested in Immersive Fox Ltd Immersive Fox uses AI to generate custom videos in minutes and auto-translate into 50+ languages in seconds, letting businesses create quality video content without the need for film crews, studios, actors, or cameras.

- 20-Mar-23

Access EIS invested in MyPocketSkill MyPocketSkill creates earning opportunities for young people by connecting them with households and businesses to complete paid tasks such as tutoring, social media management, music coaching, digital design and other digital tasks. In the process it delivers short financial education videos to nudge teenagers towards better financial skills and behaviours.

- 24-Feb-23

Access EIS invested in Seep Seep produces 100% plastic free cleaning products made from sustainable and renewable materials, which are compostable, or fully biodegradable. They are free from the toxins that usually feature in plastic-based products, and are sleek, stylish and effective.

- 13-Feb-23

Access EIS invested in Neat Neat develops a range of cleaning products with a focus on sustainable packaging and reusable bottles. They are free from single-use plastic, instead using aluminium to create long lasting containers that can be refilled indefinitely.

- 1-Feb-23

Access EIS invested in Itza Itza develops software and offers educational services with the aim of making online and digital learning more engaging. Its first product, GET SET, is currently in beta.

- 19-Jan-23

Access EIS invested in Five Alarm Bio Five Alarm Bio develops anti-ageing therapeutics designed to help extend the lifecycle of cells and to avoid illnesses associated with ageing.

- 1-Dec-22

Access EIS invested in Incard Incard is a payment solution designed exclusively for e-commerce, entrepreneurs, dropshippers and influencers. It facilitates faster international payments, allows the issue of virtual cards for employees and integrates with digital platforms. It also comes with built-in accounting software as part of the Incard app.

- 14-Nov-22

Access EIS invested in Untap Untap scientifically monitors community health including COVID-19 prevalence in offices, schools, hospitals, care homes, colleges, manufacturing, training facilities and more.

- 31-Oct-22

Access EIS invested in Here We Flo Here We Flo designs and sells a range of female hygiene and safe sex products that aim to be more sustainable, contain zero toxins or petroleum plastics, and are pH balanced. Their tampons and bladder pads use sustainable organic bamboo and cotton, and their condoms are vegan and CO2 neutral.

- 10-Oct-22

Access EIS invested in Lab 1 Lab 1 provides data analytical services for niche online datasets such as emerging social media and the dark web, aimed at providing businesses with cybersecurity and risk analysis services.

- 05-Oct-22

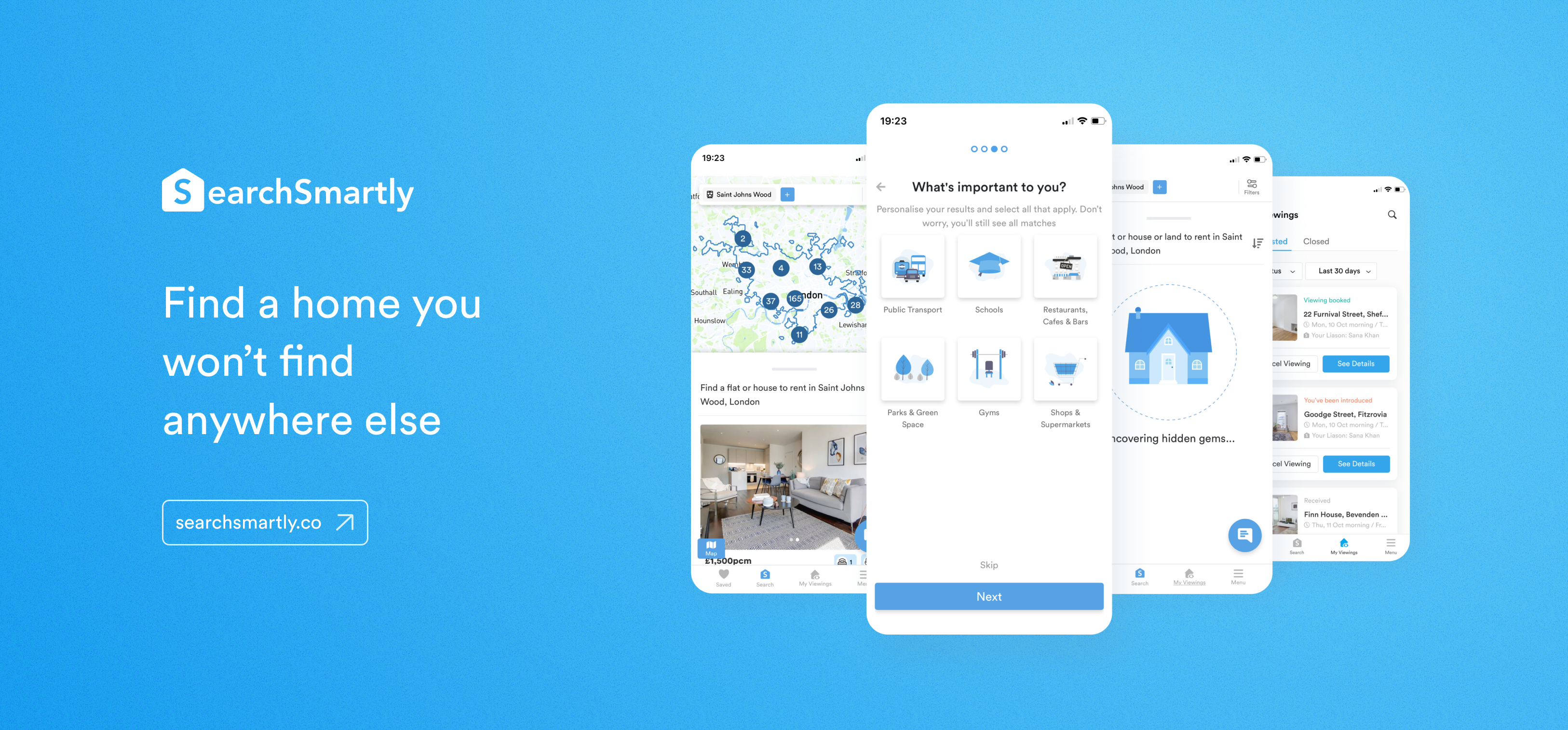

Access EIS invested in Search Smartly SearchSmartly is an AI-led, hyper-personalised property marketplace, helping users find the right home at the right time in one seamless transaction.

- 03-Oct-22

Access EIS invested in Temple Temple is reinventing loyalty cards with creators and communities in mind. It allows users to reward past and future participation with exclusive rewards like private Discord channels, limited merch drops, back stage access and more.

- 28-Sep-22

Access EIS invested in SilverRay SilverRay has developed a new detector technology based on a low cost semiconductor ink that can be coated on arbitrarily shaped surfaces over large areas. This new generation of detectors can be used in many applications, such as dose evaluation during cancer therapy, portable security screening, and medical imaging in the field, among others.

- 07-Sep-22

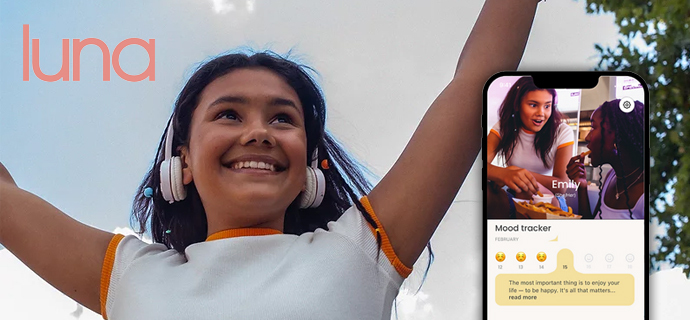

Access EIS invested in Luna Luna's app provides health and wellbeing information to teenagers, from skincare to sexuality, mental health and sleep habits. Built by medical professionals to overcome gaps in resources provided through education, it aims to empower teenagers to make informed decisions.

- 02-Sep-22

Access EIS invested in CARiFit CARiFit is a post natal workout system that incorporates babywearing, and provides new mothers with access to virtual classes and an active community.

- 31-Aug-22

Access EIS invested in Wild Hydrogen Wild Hydrogen's carbon negative process converts organic waste into clear hydrogen, while capturing and storing carbon dioxide.

- 26-Aug-22

Access EIS invested in Syndi Syndi provides the digital infrastructure to offer personalised and effective digital health support within organisations.

- 19-Aug-22

Access EIS invested in Herd Herd invites users to predict the outcomes of sports events with their friends via its dedicated mobile application.

- 15-Aug-22

Access EIS invested in Presto Presto produces uncomplicated coffee for every kind of coffee drinker, emphasising freshness and quality. It's serious about social and environmental impact, uses 100% recyclable packaging, and has a partnership with the UK's most sustainable roastery to keep carbon emissions low.

- 8-Aug-22

Access EIS invested in Toastie Toastie aims to create a deeper connection between children and the environment, with a view to promoting positive mental health and wellbeing in future generations coupled with a lifelong desire to nurture and protect our planet.

- 13-Jul-22

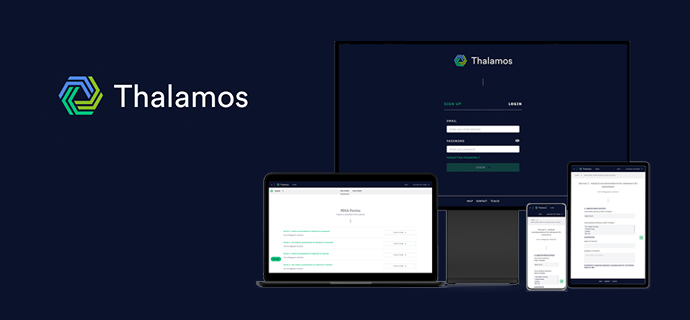

Access EIS invested in Thalamos Thalamos joins up admission, treatment and discharge care pathways to improve patient outcomes in mental healthcare.

- 1-Jul-22

Access EIS invested in Connectd Connectd empowers the early-stage ecosystem to make and manage meaningful connections. Through its proprietary reporting suite, portfolio management system and smart match technology, Connectd is removing the friction that hinders growth for founders, investors and startup advisors.

- 29-Jun-22

Access EIS invested in Beeline Beeline has created a smart compass and app system that guides cyclists and motorcyclists to their destination, making cycling safer and more accessible to more people.

- 27-Jun-22

Access EIS invested in Clerkenwell Clinics Clerkenwell Clinics are uniquely positioned to accelerate and partner with psychedelic drug developers to bring life-changing mental health treatments to patients with high unmet clinical need.

- 27-Jun-22

Access EIS invested in Lumi Network Lumi's enquiry-based programme gives students autonomy over their direction of study as they tackle the most complex issues facing mankind.

- 16-Jun-22

Access EIS invested in Peazi Peazi is the only order and pay solution with no download and no sign-up necessary. Its mobile ordering system combines ease and speed with a personalised waiter service, so customers can order, eat, drink and pay with no fuss.

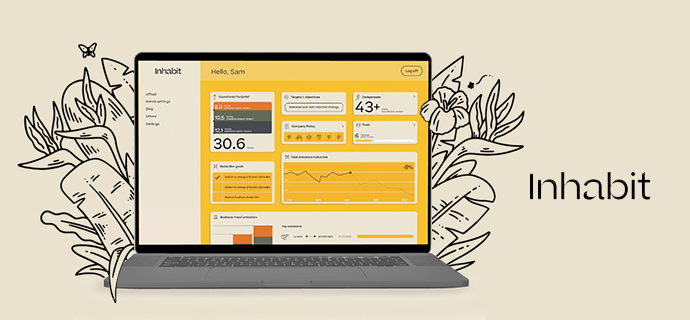

- 10-Jun-22

Access EIS invested in Inhabit From the breakdown of Operational Carbon Footprint to major emissions, Inhabit helps businesses accurately measure their climate impact then builds them a customised reduction plan to meet their goals.

- 13-May-22

Access EIS invested in Restory The Restory provides restoration, cleaning and repair services for luxury goods, from shoes to handbags and clothing. Its team of specialists and artisans work to devise solutions using the most up to date methods, and provide training to the next generation of master restorers.

- 11-May-22

Access EIS invested in Sans Matin Sans Matin creates stylish, versatile footwear designed to work in every environment, formal or otherwise. Ethically manufactured – each pair is handmade by a family-owned-and-run atelier using locally sourced materials – they also offer a recycling service for old San Matin shoes, where items in good condition are sent to charities, while the rest are repurposed for other uses.

- 9-May-22

Access EIS invested in PlanD PlanD operates a corporate finance advisory firm that aims to help founders and investors when private investments go awry by providing a range of consultancy services, connecting shareholders looking for an exit with buyers, and sourcing turnaround investment.

- 27-Apr-22

Access EIS invested in Genie Genie is the creative industries' first automated talent agent, underpinned by an intelligent AI powered matching algorithm, which matches companies to the best talent at speed. The SaaS platform enables creative companies to be strategic about building an agile, hybrid, workforce.

- 25-Apr-22

Access EIS invested in Pri's Puddings Pri's Puddings make indulgent treats using just five natural ingredients, sweetened by dates, so they contain 50% less sugar than mainstream competitors. They’re plant-based, gluten free and wrapped in 100% recyclable packaging.

- 22-Apr-22

Access EIS invested in Growyze Growyze is an all-in-one inventory and stock management app for pubs and bars that saves users time and money in a smarter, greener and more efficient way.

- 21-Apr-22

Access EIS invested in Tom Savano Tom Savano is on a mission to bring the world's most beautiful travel-inspired cocktails to anyone, having developed and launched a multi award-winning collection of super premium cocktails that are ready to enjoy with just the pop of a cork as if you were in the world's best bars. It currently has listings in John Lewis, CinqueCento Pizzeria and Fenwicks.

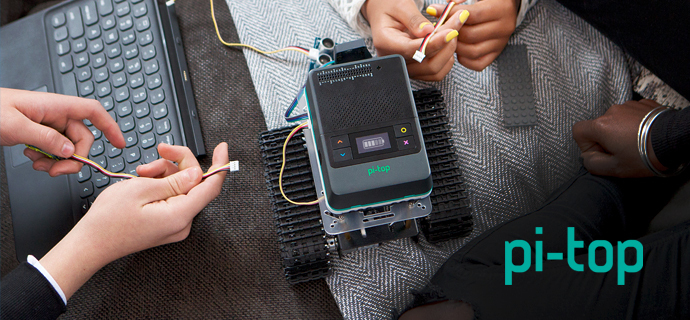

- 8-Apr-22

Access EIS invested in Pi-top Pi-top’s award-winning hardware and software ecosystem is used around the world thousands of homes, maker spaces and schools, blending physical computing and project-based learning with Computer Science and STEAM (science, technology, engineering, arts and maths) education. With its latest product, pi-top [4], educators and students get to design, code and make anything they can imagine.

- 18-Mar-22

Access EIS invested in Hoxton Analytics HoxtonAi offers people count and occupancy measurement and analysis, aiming to optimise the use and planning of physical spaces, which account for 50% of the world’s resource usage.

- 16-Mar-22

Access EIS invested in Slip Slip is an award winning startup looking to humanise digital receipts and customer information. It's proprietary tech provides a robust solution for consumers and retailers to transform transactions and receipt waste into meaningful interactions.

- 24-Feb-22

Access EIS invested in Learney Learney is an online AI tutor that accelerates learning for knowledge work, adapting to the user by continuous assessment through short questions, and guiding their next steps. It presents knowledge as a system of nodes, and aids users in finding the best path to their goals, while drawing on the principle findings of cognitive science on learning and memory.

Investing in

Access EIS.

Once you've read about the fund, our online investment form takes around 10 minutes to complete.

Get started