What is the Enterprise Investment Scheme (EIS)?

EIS tax reliefs

When and how to claim EIS relief

Downloadable guide to EIS

What is the Enterprise Investment Scheme (EIS)?

The Enterprise Investment Scheme (EIS) is a venture capital scheme created by the UK government to help new businesses raise finance by offering generous tax reliefs to investors. The scheme has been around since 1994, so it's a well-established part of the UK tax landscape for investors.

To date, around £24bn in funds have been raised through EIS. Over Over 33,000 companies have received investment.

This video gives a useful introduction to the scheme

Note* If you’re a company looking for information on EIS please read more about what it takes to be an EIS qualifying company.

How does EIS work?

Under the EIS scheme, investments made into qualifying companies are eligible for a suite of tax benefits. Investors receive an EIS certificate when they purchase shares, and are able to claim the benefits in their next tax return.

A common concern is that EIS investing can create excessive tax admin, or that multiple tax returns must be filed. This is not the case: you can append details of all your investments to one single tax return.

What tax relief do I get?

(Note: Shares must be held for three years to receive tax reliefs. Reliefs can be claimed sooner, but if the shares are disposed of in less than three years, any income tax relief in respect of those sold will be wholly or partly withdrawn, and any gain on the disposal will be chargeable to capital gains tax.)

EIS investors can claim the following tax benefits on their investments:

Up to 30% income tax relief.

The maximum investment that can be claimed on in a single year is £1m. This annual maximum rises to £2m if investments are made in Knowledge Intensive Companies (KICs).

No tax on EIS gains.

If EIS shares are sold at a profit, any gain made on that investment is tax free. Given the potential returns involved with investing in startups, this can be a significant tax break. To qualify, income tax relief on the shares that are sold must already have been claimed.

Capital gains deferral.

Any gain you make through selling other assets can be reinvested in EIS, and deferred for as long as the investment is held. There is no limit on the gains that can be deferred in this way. While the rules state you cannot claim tax relief on investments into companies with which you are ‘connected’ by significant financial interest or employment, these rules do not apply where only deferral relief is claimed. More on capital gains relief.

Inheritance tax relief.

EIS shares are exempt from inheritance tax, as they qualify for Business Property Relief (BPR), but shares must have been held for two years prior to death.

Loss relief.

Investing in startups is risky, and some companies won’t make it. Loss relief allows investors to offset a loss on an EIS investment against their income tax or capital gains tax bill.

SyndicateRoom does not provide investment or tax advice. If you require either please speak to a professional advisor or accountant who may provide you with support services.

Get your free guide to the Enterprise Investment Scheme

All you need to know about the Enterprise Investment Scheme.

Featuring an analysis of UK investor trends, investment case studies and an EIS cheat sheet.

How do I calculate my tax relief?

You can use our EIS calculator to get an idea of how much tax relief you would receive on a given investment.

EIS tax relief examples.

Scenario: A higher-rate (45%) taxpayer invests £10,000:

| Company fails | Company breaks even | Company doubles in value | |

|---|---|---|---|

| EIS investment | £10,000 | £10,000 | £10,000 |

| Income tax relief | -£3,000 | -£3,000 | -£3,000 |

| Net investment | £7,000 | £7,000 | £7,000 |

| Proceeds on disposal | £0 | £10,000 | £20,000 |

| Loss relief | -£3,150* | - | - |

| CGT payable | - | nil | nil |

| Net profit/loss including income tax relief | -£3,850 | £3,000 | £13,000 |

The loss after income tax relief is £7,000 x 45% = £3,150

By comparison, an individual investing £10,000 in a non-eligible company who exits with a 2x return would see a profit, after CGT at the current 20% rate, of just £8,000. Clearly this is a simplification, and is is important to read and understand the further information regarding the Enterprise Investment Scheme tax reliefs set out below.

How do I claim my tax relief?

Investors claim tax relief when they complete their annual tax return, giving details of each of their EIS qualifying investments, then submitting this to HMRC. Alternatively, investors can complete the claim form on their EIS3 or EIS5 certificate, and submit this to HMRC.

You'll need to provide HMRC with the following information:

- The names of the companies in which you’ve invested.

- The amounts, per company, for which you’re claiming relief.

- The share issue date (often different from the date you invested).

- The HMRC office authorising the issue of the EIS3 certificate and its reference (as shown on the certificate).

The above information is on the EIS3 certificates that the company, or fund will supply you with post investment. These certificates are typically issued three to four months after the close of the companies' funding rounds. HMRC takes time to process them based on information the company supplies to them.

For Access EIS investors, all the information you need to claim tax relief, including EIS3 certificates and a spreadsheet showing the details above, can be downloaded from your Investor Dashboard.

View our step-by-step guide to claiming EIS relief

How much can I invest into EIS?

In most cases, investors can claim tax relief on up to £1m investing in EIS eligible companies. This increases to £2m when investing into knowledge intensive companies (KIC)

Knowledge Intensive Companies

In the specific case of investments made into Knowledge Intensive Companies – which are companies that put a high enough proportion of their operating costs into research and development, create and use original intellectual property as a significant part of the business, and/or have 20% of a higher-educated workforce involved in R&D – investors can claim tax relief on up to £2m of investment in a single year.

How do I invest in EIS?

Direct investments

Investing directly in startups that qualify for EIS, without going through a fund, gives the investor more control over their choice of investments, but puts the responsibility of due diligence and decision making over voting on company resolutions solely in their hands. It also requires the investor to discover new investment opportunities for themselves, so a strong network of industry contacts can be advantageous.

Investing through a fund

Many EIS investors make their investments through funds. In this case, the fund handles the process of selecting and investing in new opportunities. The fund builds a portfolio for each investor in exchange for a fee.

This approach has a much lighter administrative burden for the individual investor. Due diligence is carried out by the fund (and in the case of Access EIS, by our super angel co-investors as well).

While the investor does not choose the individual investments, they can make a choice about which fund to commit to. Different funds will have different approaches to investing, some will focus on a given sector, while others will be sector agnostic, some will build small portfolios to focus investment, others will build larger portfolios to spread risk more widely.

It’s important to choose a fund which suits the way you want to invest, and an approach which gives you the best chances and multiples of returns with the lowest amount of risk. Also check the funds FCA register number to ensure they are legit.

Read more about EIS investments

What are the alternatives to EIS

What other types of products and services do investors consider alongside EIS, and how are they different?

Venture Capital Trusts (VCT)

VCTs offer investors exemption from income tax on dividends on ordinary shares, and income tax relief of 30% on the value of new ordinary shares subscribed (capped at £200,000 per tax year) providing that shares are kept for at least five years. You may also be able to get disposal relief through VCTs.

You can learn more about tax reliefs in our comparison of EIS vs VCTs.

The Seed Enterprise Investment Scheme (SEIS)

SEIS is a scheme similar to EIS, with the difference being that it invests in companies at an earlier stage. Because the risk is higher, it offers income tax of 50%. But it has an annual investment limit of £100,000. You can learn more about tax reliefs in our comparison of EIS vs SEIS.

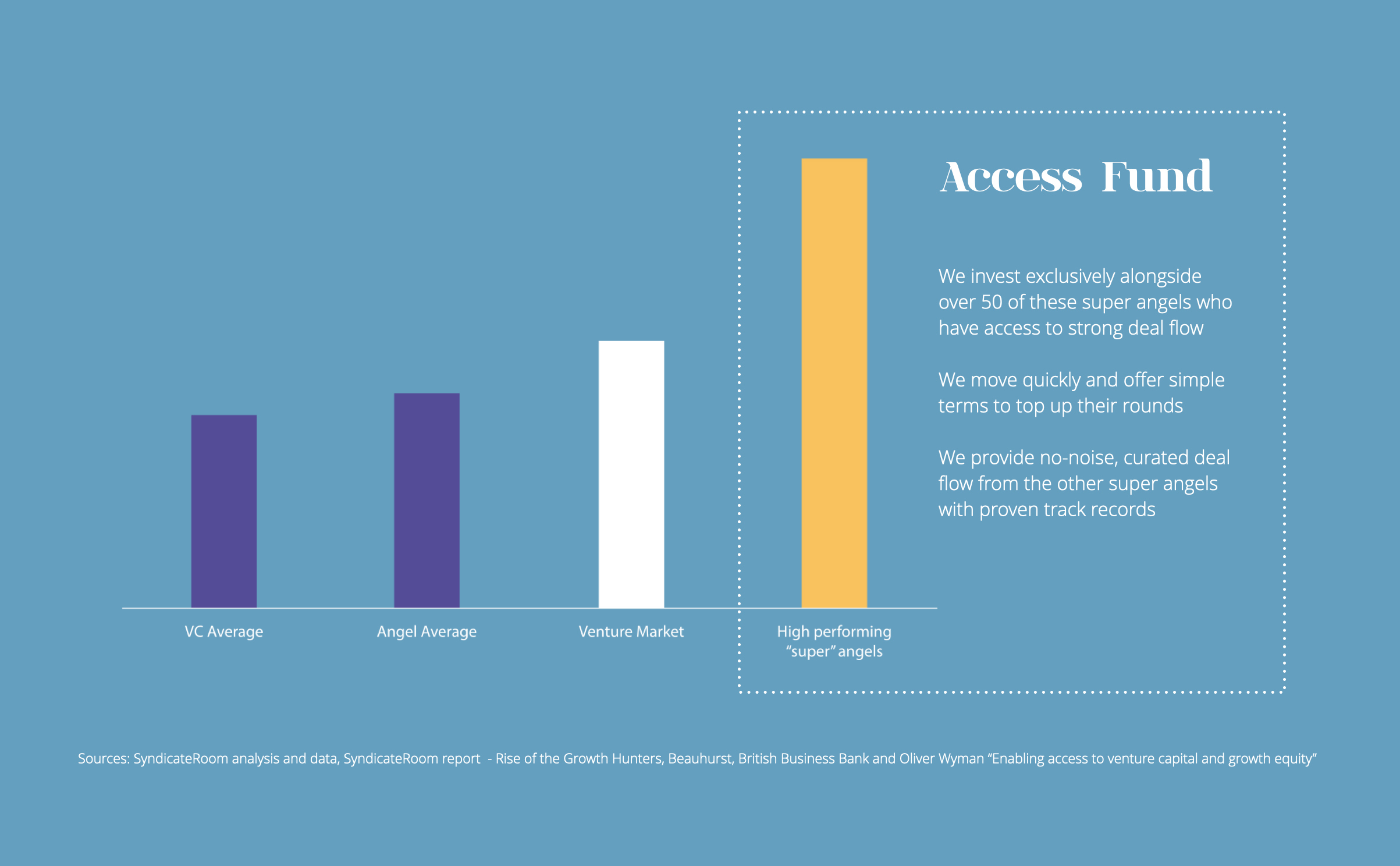

What's different about your fund, Access EIS?

SyndicateRoom's fund, Access EIS, tracks the performance data of over 1,000 active startup investors. It then selects and co-invests with some of the best-performing “super angels” with the aim of replicating their collective success, and diversifying your investment across at least 50 super-angel-backed startups to minimise risk and capture as many potential “blockbusters” as possible. The angels we co-invest with significantly outperform the market.

We make the process of claiming relief on multiple investments as simple as possible for our investors.

Find out more about the fund and the innovative startups we've backed here. If it’s right for you, we'd love to welcome you into our community of more than 500 investors.

Disclaimer.

The information on this page does not constitute financial advice and is provided on an information basis only, based on research using the following sources: